Address: Front office : Twin Centre Tower A 6th floor Corner boulevard zerktouni and boulevard El Massira Casablanca Back office : espace ghazwani, Boulevard Ifni, Casablanca

Opening hours :Mon - Fri: 9am-12.30pm and 2pm-6pm Sat: 9am-12pm

Address: Front office : Twin Centre Tower A 6th floor Corner boulevard zerktouni and boulevard El Massira Casablanca Back office : espace ghazwani, Boulevard Ifni, Casablanca

Opening hours :Mon - Fri: 9am-12.30pm and 2pm-6pm Sat: 9am-12pm

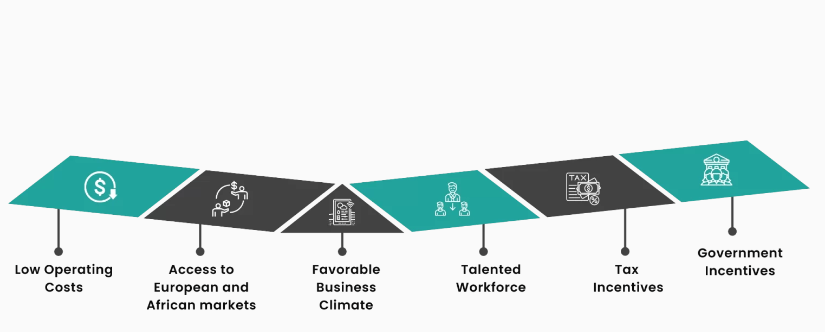

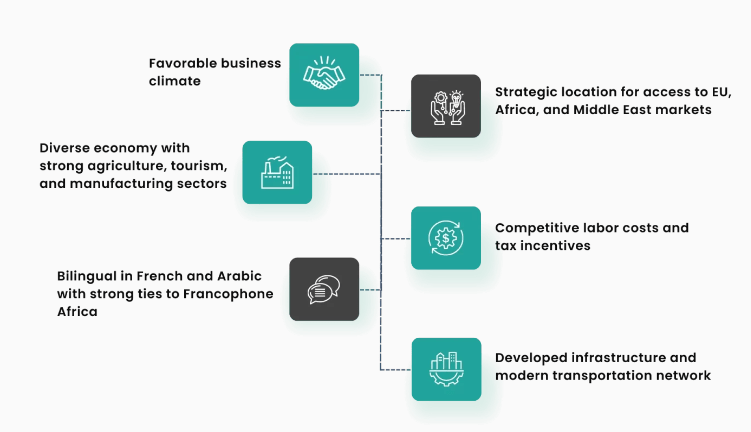

The economy of Morocco 🇲🇦 has made impressive advancements in the past decade 🗓️💼🚀, becoming a popular destination 🌍 for investors 💸 and entrepreneurs 👨💼👩💼 from abroad. Eventually, Morocco’s government 🏛️ has committed to enticing entrepreneurs to start a business 🏗️🌱, by offering tax incentives 🌟📉.

Establishing an organization in Morocco 🇲🇦 is now more straightforward than ever, taking just two days 📆⏳ to submit your incorporation application 📝. With an inflation rate under 2% 💹, this makes Morocco a particularly attractive area 🌍🔍 for setting up your business 🏢💼.

Recently, Renault 🚗 has established a manufacturing unit worth $1.5 billion 💲 in Morocco, capable of producing over 150,000 cars 🚘🏭 annually 📆.

If you’re planning to register a company in Morocco 🇲🇦, it’s essential to thoroughly understand the different business entities and the country’s rules & regulations 📜⚖️, as these can impact the process of company registration in Morocco.

The procedure for company registration in Morocco typically involves the following steps:

After the successful completion of the Morocco company registration process, you can start operating the business smoothly 🚀.

Here are a few of the documents that may be expected for company registration in Morocco:

It is important to note that the specific document requirements can vary depending on the type of company and the industry it operates in. However, our professional experts will help you out with the process, if you wish to reduce the chances of errors 🤝🔍.

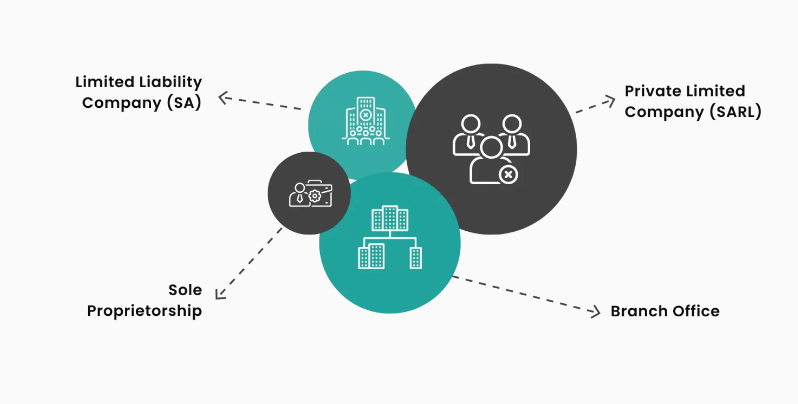

In Morocco, the following types of business entities can be registered when you consider registering a company:

The most common entities are:

A Limited Liability Company (SA) in Morocco must have a minimum of five shareholders 👥👤, which can be either legal entities or individuals. The liability of each shareholder is limited to the extent of their shareholdings 💼. The company is identified not by a name or corporate identity, but by an official trade name 📛.

A Private Limited Company (SARL) in Morocco serves as an intermediary between individual associations and capital groups 💰. The minimum equity capital required for registering a SARL is around 10,000 MDh 💵. This entity type must submit a memorandum of agreement during incorporation, and its capital stock must be clearly outlined and paid at the time of company formation 📑.

A subsidiary or branch of a foreign company in Morocco is treated as a separate legal entity. The Moroccan branch must provide specific information about its parent company, including details of its representatives and delegated powers 📋🔍.

Foreigners can establish sole proprietorships in Morocco. In this setup, the business is run by an individual who is personally liable for the company’s obligations, up to their personal and business assets 🛠️. The company must be registered with the Commerce Registry and the tax authority 📊🧾.

It’s important to understand each type’s nuances and requirements for successful company registration in Morocco 🇲🇦📝.

To be eligible for company registration in Morocco, the following requirements must be met:

Various Taxes on Morocco Company Registration:

The cost to register a company in Morocco varies depending on factors like the type of business entity, the amount of share capital, and the legal and administrative fees involved 📊📑.

Typically, the cost for registering a company, such as a limited liability company, includes notary fees, Trade Register fees, and Chamber of Commerce fees 💼🏛️📃.

Additionally, foreign nationals may need to account for the cost of a work permit 🌍📜. The cost of obtaining a business license also varies depending on the type of company 📄💳.

It’s advisable to consult with business experts to get a more accurate estimate of the total costs involved in company registration in Morocco 🤝🔍.

There are several reasons why someone may choose to register a company in Morocco:

When considering Morocco Company registration, an interested investor must be aware of legal procedures 📚⚖️, international regulations 🌐, and adequate investment 💵 to succeed.

Morocco’s Tanger-Med port 🚢 is one of the busiest in Africa, offering routes to the European market, suggesting a good ROI for channel traders and exporters 📈🌍.

Understanding the social 🤝, cultural 🎭, and political 🏛️ aspects that affect a business’s setup and expansion is crucial.

However, international launches that are poorly researched can end in disaster, with time ⏳, money 💸, and energy 🔋 being lost due to poor planning.

While registering a company in Morocco might seem daunting, seeking assistance from professional experts 🧑💼 from BH ADVISER is recommended to guide you through the process of company registration in Morocco 🇲🇦👥.

Here are some frequently asked questions (FAQs) related to company registration and doing business in Morocco:

The minimum capital requirement depends on the type of company. For a Limited Liability Company (SARL), it’s typically around MAD 10,000.

The registration process can take anywhere from a few days to a few weeks, depending on the company type and the completeness of the submitted documents.

Yes, foreign nationals can own 100% of a company in Morocco, with no mandatory requirement for a local shareholder.

Morocco offers tax incentives for investments in sectors like renewable energy, tourism, and industrial development.

The corporate tax rate in Morocco is generally around 28%, but this can vary depending on the company’s size and sector.

Yes, having a registered business address in Morocco is a legal requirement for company registration.

While some steps can be initiated remotely, certain procedures may require physical presence or a legal representative in Morocco.

Yes, foreign nationals typically need to obtain a work permit to legally operate a business in Morocco.

French and Arabic are the primary languages used in business settings in Morocco, with English increasingly being used in international business contexts.

Yes, with its strategic location, growing economy, and government incentives, Morocco is becoming an increasingly popular destination for startups, especially in sectors like technology and renewable energy.