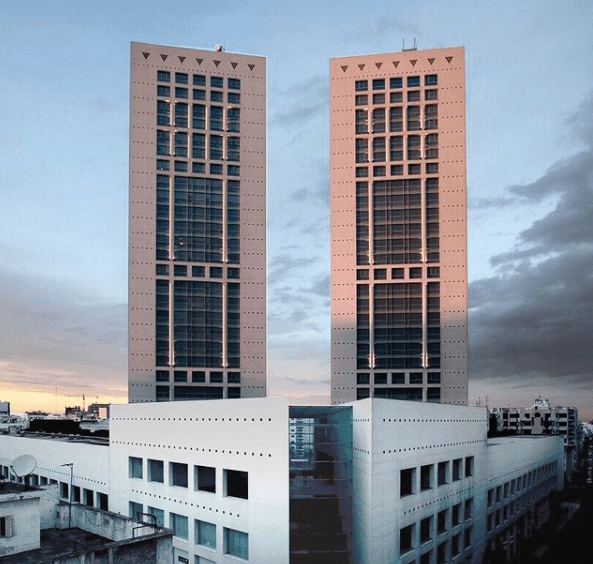

Address: Front office : Twin Centre Tower A 6th floor Corner boulevard zerktouni and boulevard El Massira Casablanca Back office : espace ghazwani, Boulevard Ifni, Casablanca

Opening hours :Mon - Fri: 9am-12.30pm and 2pm-6pm Sat: 9am-12pm

05.01.2024 (last update)| Bh Adviser | Morocco

Be a customer of the first online accounting firm in Morocco

Morocco is a country known for its openness to foreign investment and, as such, it occupies the third position in Africa in the World Bank’s Doing business 2021 ranking. Doing Business 2021 de la Banque Indeed, setting up a business in Morocco is quite simple as it only takes a few days to file for incorporation and register a limited liability company or a joint stock company.

This enables investors, whether local or foreign, to get up and running quickly and start focusing on business opportunities in Morocco.

That said, incorporating a company will require thorough preparation in advance and tailored support to avoid any potential complications during the incorporation process.

In this light, we will review the various steps involved in incorporating a company and starting a business in Morocco.

Foreign businesses have several legal forms to choose in order to carry out their activities in Morocco. The different types of company in Morocco fall into three main categories:

Partnerships: General partnership, restricted partnership and joint venture.

Capital Companies: Limited Liability Company, Public Limited Company, Simplified Public Limited Company and Partnership limited by shares.

The Branch Office

In Morocco, the legal forms of companies most commonly used are the limited liability company (SARL) and the public limited company (SA).

The SARL is the legal structure usually chosen by investors since it represents more than 97% of the 162,877 companies incorporated during the period 2010-2014 according to the Moroccan Office of Industrial and Commercial Property (OMPIC).

For these reasons, we will only explain the features of the SARL, the SA and the branch:

This legal form is generally suitable for small and medium-sized enterprises and has the following main characteristics

Non-free transferability, except between spouses or relatives, and non-negotiability of the company shares.

A minimum of two founding partners, except for single-member SARLs.

There is no lower limit in terms of minimum share capital. However, it is preferable for reasons of credibility with your future partners (banks, customers, suppliers) to have a share capital of at least 100 000 MAD.

The director(s) of the SARL are not required to be resident in Morocco or to hold shares in the company.

If the SARL’s turnover (excluding tax) exceeds MAD 50,000,000, an auditor must be appointed.

This is the second most popular legal form in Morocco. The shareholders hold a negotiable security (share) and their liability for losses is limited to the amount of their contribution.

The main characteristics of the SA are :

the free transfer and negotiability of shares.

A minimum of 5 shareholders.

Minimum share capital of 300,000 MAD or 3,000,000 MAD in case of a public offer

An auditor must be appointed.

There are two types of public limited companies:

A public limited company managed by a management board (at least three members and at most twelve members).

A public limited company run by a management board responsible for the management of the company and a supervisory board which controls the management of the management board on behalf of the shareholders.

A Branch Office is a company established by a foreign parent company. As such, it has no legal authority (legal personality) or assets (own property or share capital) separate from the parent company.

The shareholders of the SAS must be companies with a share capital of at least 2,000,000 dirhams, which is the value of exchange in foreign currency.

The SAS is a joint stock company which is not subject to restrictive rules such as those of a public limited company or a limited liability company. The management provisions are in the articles of association. The only requirement is to appoint a chairman.

A Branch Office is a company established by a foreign parent company. As such, it has no legal authority (legal personality) or assets (own property or share capital) separate from the parent company.

The Branch Office is managed by the legal representative of the head office, who is usually an employee.

As the SARL is the legal form most used by investors in Morocco, we will describe its incorporation process. The incorporation of SAs and branches will be the subject of another blog post.

The Negative Certificate is an administrative document issued by the Moroccan Office of Industrial and Commercial Property (OMPIC). This administration acts as a business search in Morocco or a business directory in Morocco and periodically updates the list of businesses in Morocco. It certifies that the business name applied for by the investor is available and can be registered in the trade register.

The application for a Negative Certificate is made online on the OMPIC website, and its validity period has been recently reduced to 90 days.

To be duly registered, any company in Morocco must have a registered office address.

In this respect, two options are possible:

Renting premises by signing a commercial lease contract.

To be domiciled in a business centre.

The domiciliation is generally the most popular option for companies because of its low cost and simplicity. Indeed, 72% of newly created companies in Casablanca have used domiciliation in their start-up phase, according to estimates by the Moroccan Association of Business Centres (AMCA).

This process is mandatory for SAs and SARLs with paid-up capital exceeding MAD 100,000.

This consists of opening a temporary bank account in a local bank where the company’s share capital is transferred.

Once the capital has been transferred, the bank issues a capital blocking certificate.

The drafting of the company’s articles of association is the most critical stage in the formation of a company in Morocco.

In fact, the articles of association are the company’s founding documents and cover all the rules governing relations between shareholders and towards third parties. It is an essential document which will define the rules which will guide your company and which will represent the “constitution” of your company.

This document can be drafted in two different ways:

It is recommended that you call on a professional to draw up the articles of association in order to avoid any inconvenience or unpleasant surprises at the commercial court.

In principle, it is not a good idea to use standard templates (which can easily be found on the Internet). These templates will never correspond to the specificities of your company and its operating model.

Having completed the drafting of the Articles of Association, the founding partners can sign the final Articles of Association without being physically present in Morocco.

Negative certificate, Final Articles of Association of the company, CRI single form, Copies of the identity cards or passports of the directors and shareholder representatives. Articles of Association and extract from the commercial register of the parent company, if applicable. All the incorporation documents are then filed with the Regional Investment Centre in the city where the company’s registered office is located.

The CRI acts as a one-stop-shop for the incorporation of companies in Morocco and brings together the services of the commercial court, the tax authorities, the Moroccan Office for Business Research (OMPIC), and the Social Security (CNSS).

In practical terms, the company is usually incorporated within a week to 10 days from the date of filing.

The documents issued by the CRI include

A Form for the notification of the company's identifiers.

A Declaration of Existence issued by the tax authorities.

A Certificate of Registration with the National Social Security Fund (CNSS)

The originals of the duly registered articles of association.

The Trade Register issues the extract from the Trade Register called Model J within one week of the company’s constitution.

As soon as the company is incorporated, the formalities of legal publication in a newspaper and in the official bulletin must be completed.

Upon completion of these steps, the entire incorporation file is sent to the bank for the final opening of a business bank account.

Under the foreign exchange regulations foreign investors are allowed to freely transfer abroad all the proceeds of their investments in Morocco(dividendes,sale price of shares and liquidation proceeds) provided that the initial investment is made in one of the foreign currencies listed by the Moroccan central bank.

In view of the subsequent transfer of dividends abroad, a report of the foreign investment in Morocco must be submitted to the Office des Changes.

Lastly, the final tasks to be completed are ordering a seal for your company and choosing an accounting firm for bookkeeping and tax compliance.

When starting a business in Morocco, it is recommended that a professional carry out a preliminary study of the legal, social, and tax implications of your project in Morocco.

The foreign investors must transfer the initial paid-up capital in foreign currencies to benefit from the free transfer of the profits generated by these investments.

It is important not to use a standard model of statutes that do not correspond to the specificities of your company and its operating model.

It is recommended to draft a partnership agreement when the company has several shareholders.

It is also advised that you use an English-speaking advisor (accountant or business lawyer)to avoid any potential problems during the incorporation process.

Lastly, intellectual property aspects should not be overlooked. It is therefore strongly recommended to protect your business with a local trademark to avoid any potential litigation.

After the Crown pandemic, Morocco developed a strategy to attract foreigners and entrepreneurs willing to start a business in Morocco, with operating basic freedom for investors and entrepreneurs willing to start a business in Morocco the right to transfer profits, the right to transfer products, and the facilities to open bank accounts in Morocco.

Morocco has carried out several economic, social, and legal reforms to ensure and facilitate the residence of foreign investors in Morocco by encouraging tax measures, simplification, and standardization of procedures through the creation of regional centers for investment.

Morocco has one of the best investment climates in the world, offers a luxurious environment, and is the largest consumer market in Africa. It attracts investors with its stable management and protection of intellectual property rights in Morocco.

Morocco attracts many investors to start businesses in Morocco, so why not become one of these investors?

A ” business startup ” is a company that is unclear 1. What is its market? 2. Who are its target customers. 3. How to profit income.

Hanane Belaskri is an Accountant and Tax Advisor, She is the Managing Partner of BH Adviser,the accounting firm that supports foreign companies in their accounting, payroll and tax compliance, so that they can grow with confidence in Morocco and Africa.

Do not hesitate to contact us for more information regarding the incorporation of your company in Morocco.

Choose the right business structure for your Moroccan venture 🇲🇦. Connect with local experts for guidance and smooth setup. Start now! 🚀💼

Contact usIncorporating an LLC in Morocco includes company registration, opening a bank account, legal office address, and administrative fees.

Morocco, a prime North African business hub, ranks 53rd in ease of doing business, attracting investors interested in the region.

Individuals with national ties or permanent residents through naturalization may be granted permission.

No, Morocco does not have a policy of no taxes for foreigners. Foreign residents are taxed on their Moroccan-sourced income, while non-residents are taxed only on their income from Moroccan sources.

To start an LLC in Morocco, you need to:

In Morocco, SARL stands for “Société à Responsabilité Limitée,” which is the equivalent of a Limited Liability Company (LLC). It’s a business entity where the liability of the shareholders is limited to their contributions.

In Morocco, several legal forms of business exist, including:

1. Individual Enterprise (EI): A business owned and operated by a single individual.

2. Limited Liability Company (SARL): Similar to an LLC, with shareholders’ liability limited to their contributions.

3. Public Limited Company (SA): Suitable for larger businesses, can offer shares to the public.

4. General Partnership (SNC): Partners have unlimited liability.

5. Limited Partnership (SCS): Combines general partners with unlimited liability and limited partners with liability restricted to their contributions.

6. Branch of a Foreign Company: An extension of a foreign company operating in Morocco.