Address: Front office : Twin Centre Tower A 6th floor Corner boulevard zerktouni and boulevard El Massira Casablanca Back office : espace ghazwani, Boulevard Ifni, Casablanca

Opening hours :Mon - Fri: 9am-12.30pm and 2pm-6pm Sat: 9am-12pm

Address: Front office : Twin Centre Tower A 6th floor Corner boulevard zerktouni and boulevard El Massira Casablanca Back office : espace ghazwani, Boulevard Ifni, Casablanca

Opening hours :Mon - Fri: 9am-12.30pm and 2pm-6pm Sat: 9am-12pm

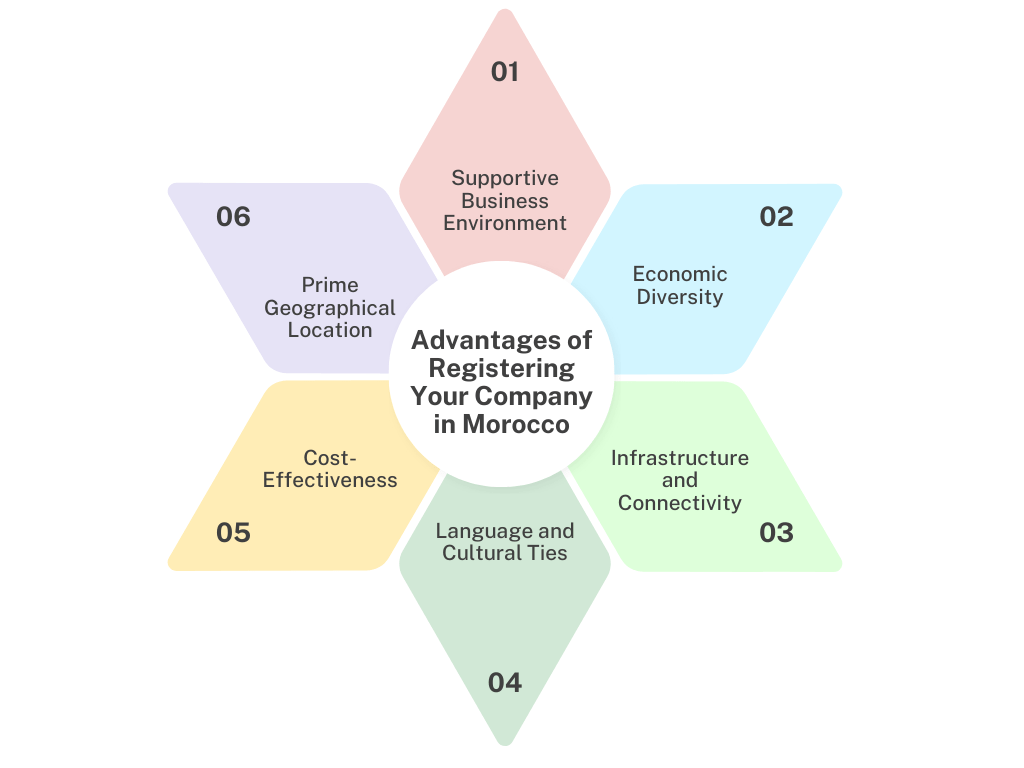

Morocco, a vibrant nation brimming with entrepreneurial spirit, has become an increasingly attractive destination for business ventures. Whether you’re a seasoned entrepreneur or embarking on your first business endeavor, understanding the Moroccan Company Registry and its documentation requirements is crucial for a smooth and successful registration process.

At the heart of company registration in Morocco lies the Moroccan Company Registry (CRI), the official body responsible for managing and overseeing company information. The CRI plays a pivotal role in ensuring transparency and adherence to legal requirements within the Moroccan business landscape.

To successfully register your company with the CRI, you’ll need to assemble a comprehensive set of documents. These documents serve as the foundation for establishing your company’s legal identity and ensuring compliance with Moroccan regulations.

The specific documents required for company registration may vary depending on the type of company being registered. It’s advisable to consult with a legal or business professional to ensure you have the correct documentation for your specific business structure.

here is a list of the different types of companies in Morocco:

| Type of Company | Description |

|---|---|

| Sole proprietorship (Entreprise individuelle) | The most basic form of business ownership, where the owner has unlimited liability and sole control of the business. |

| General partnership (Société en nom collectif) | A partnership where all partners have unlimited liability and are jointly responsible for the business’s debts and obligations. |

| Limited partnership (Société en commandite simple) | A partnership with two types of partners: general partners who have unlimited liability and limited partners whose liability is limited to their capital contributions. |

| Limited liability company (Société à responsabilité limitée, SARL) | The most common type of company in Morocco, where shareholders’ liability is limited to their capital contributions. |

| Public limited company (Société anonyme, SA) | A company with shares that can be publicly traded on a stock exchange. |

| Simplified public limited company (Société par actions simplifiée, SAS) | A simplified version of the SA, with fewer formalities and more flexibility in its management structure. |

| Foreign company branch (Succursale de société étrangère) | A branch of a foreign company established in Morocco, operating under the laws of its home country. |

| Representative office (Bureau de liaison) | An office established by a foreign company to represent its interests in Morocco but not to engage in commercial activities. |

The Moroccan Company Registry has implemented electronic registration procedures to streamline the process and enhance efficiency. Entrepreneurs can submit their registration applications and supporting documents electronically, reducing the need for physical visits to the CRI offices.

Understanding and adhering to the documentation requirements of the Moroccan Company Registry is essential for successful company registration in Morocco. By diligently preparing the necessary documents and utilizing the available electronic registration channels, entrepreneurs can navigate the registration process with ease and establish their business presence in this dynamic and promising market.

Remember, the BH Adviser serves as a gateway to the Moroccan business realm, and ensuring compliance with its documentation requirements is a crucial step towards achieving your entrepreneurial aspirations in Morocco.

A: The Moroccan Company Registry (CRI) is the official body responsible for managing and overseeing company information in Morocco. It plays a pivotal role in ensuring transparency and adherence to legal requirements within the Moroccan business landscape.

A: The essential documents required for company registration in Morocco include:

A: The CRI has implemented electronic registration procedures to streamline the process and enhance efficiency. Entrepreneurs can submit their registration applications and supporting documents electronically through the CRI’s website or through authorized intermediaries.

A: There are various types of companies in Morocco, including:

A: The minimum share capital requirement varies depending on the type of company being registered. For example, the minimum share capital for a SARL is 10,000 Moroccan dirhams (MAD).

A: The processing time for company registration in Morocco can vary depending on the completeness of the submitted documents and the complexity of the company structure. However, it typically takes around 2-3 weeks to complete the registration process.