Address: 119 Bd de la Résistance, Casablanca 20000

Opening hours :Mon - Fri: 9am-12.30pm and 2pm-6pm Sat: 9am-12pm

Address: 119 Bd de la Résistance, Casablanca 20000

Opening hours :Mon - Fri: 9am-12.30pm and 2pm-6pm Sat: 9am-12pm

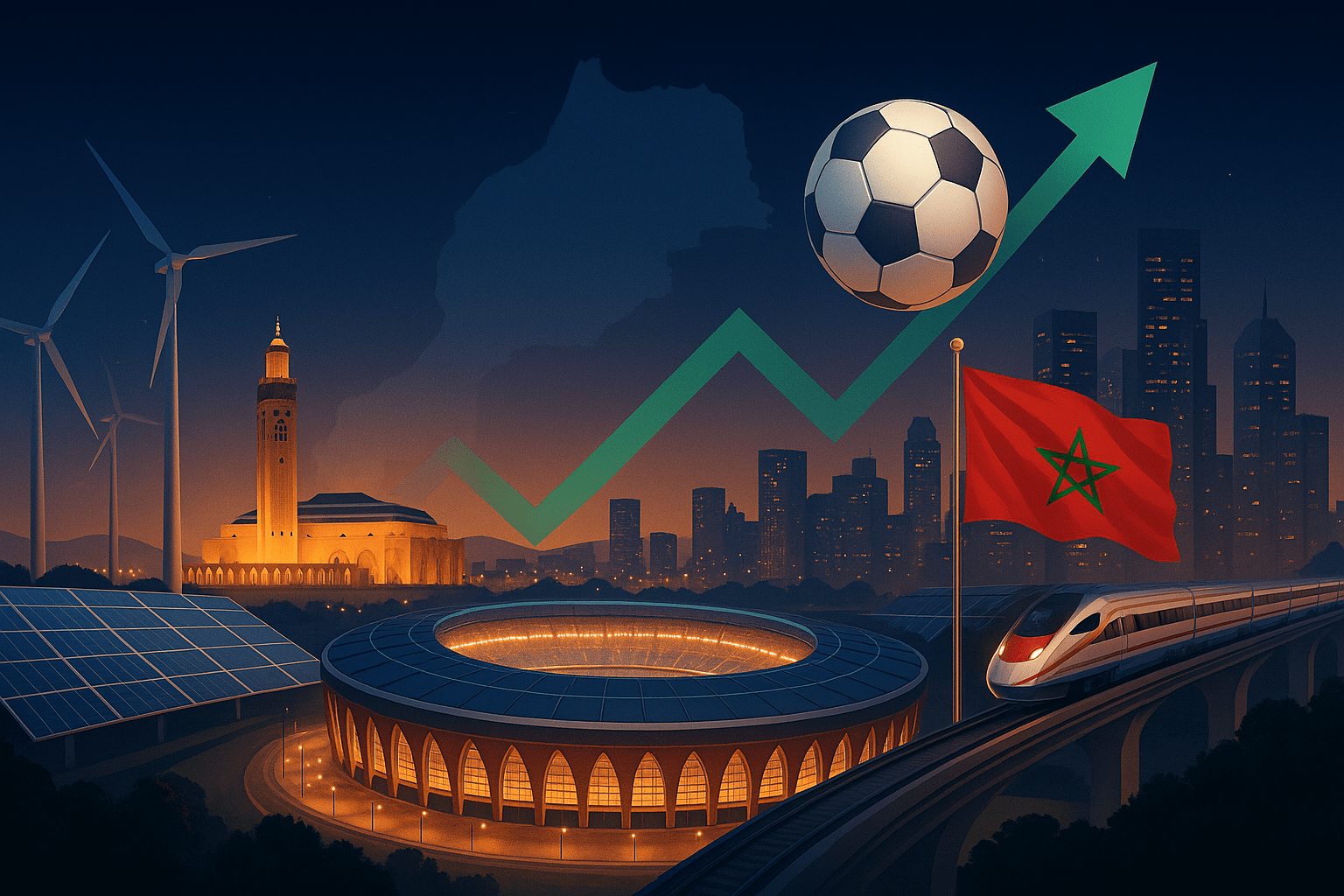

Morocco prepares for a decade of historic growth, with over EUR 100 billion in infrastructure, energy, transport, and sports investments projected by 2030.

This surge is largely driven by two landmark events: the 2030 FIFA World Cup, which Morocco will co-host with Spain and Portugal, and the 2025 African Cup of Nations. Together, these events are fast-tracking projects in green hydrogen, transportation networks, water management, stadium development, and urban infrastructure.

For foreign investors and multinational corporations, Morocco represents one of the most promising emerging markets in North Africa. But alongside the opportunities come legal and regulatory complexities, particularly in energy, land rights, infrastructure financing, and new financial instruments.

This article explores the investment opportunities, legal frameworks, and risks shaping Morocco’s transformation into a regional economic hub by 2030.

Morocco’s role as a co-host for the 2030 FIFA World Cup is more than a sporting achievement—it’s a national development catalyst. The Kingdom aims to transform its infrastructure and economic landscape, using football as the spark for long-term urban and industrial renewal.

According to government projections, Morocco will mobilize over EUR 100 billion in investment between 2024 and 2030, largely across:

The 2030 World Cup and 2025 African Cup of Nations are expected to inject billions in direct spending into Morocco, while stimulating tourism, real estate, and construction sectors. Historically, global sporting events have driven 4–8% GDP growth in host nations (source).

But Morocco is taking a long-term view. Beyond football, these projects will support:

Morocco is leaning heavily on public-private partnerships (PPPs) to finance these mega-projects, reducing strain on public finances.

Through PPP contracts and securitisation structures (FPCTs), private investors can participate in transport, energy, and urban infrastructure, while benefitting from tax and land incentives under the 2022 Investment Charter.

Morocco is emerging as a global leader in renewable energy, particularly green hydrogen, driven by its solar and wind potential and strategic proximity to Europe.

On 11 March 2024, the Moroccan government issued Circular No. 03/2024, presenting the “Moroccan Offer” to investors.

It grants:

Investors can also leverage tax incentives under the 2022 Investment Charter, including VAT exemptions, customs relief, and bonuses of up to 30% for qualifying projects.

Morocco’s green hydrogen ecosystem offers investors:

Adopted in 2022, the Investment Charter is Morocco’s centerpiece for attracting global capital. It aims to create 500,000 jobs and generate significant FDI by 2030.

Investors can benefit from bonuses covering up to 30% of project costs, based on:

Projects exceeding MAD 2 billion (~EUR 180 million) in strategic areas (water, energy, food security, technology) enjoy fast-tracked approvals and special incentives.

A key innovation is the investment agreement mechanism, allowing companies to lock in benefits and legal protections for the life of the project.

The state has also set up a one-stop shop and steering committee to reduce bureaucratic delays.

To sustain high levels of investment without excessive state debt, Morocco is embracing innovative capital markets tools.

Morocco’s Act 33-06 now allows securitisation of future infrastructure revenues (like tolls, concessions, or power purchase agreements) via Fonds de Placement Collectif en Titrisation (FPCTs).

This enables public and private sponsors to raise long-term capital by selling market-backed securities.

An example is the ONEE gas power station financing at Al Wahda, where securitisation mobilised private investment for energy expansion.

The following sectors offer the highest ROI potential for investors:

Renewable energy (especially green hydrogen), transport networks, and urban development projects tied to the World Cup are expected to deliver the highest ROI.

By leveraging investment agreements under the 2022 Charter, engaging local counsel, and structuring projects via PPP or securitisation frameworks.

Up to 30% of investment costs can be offset through bonuses, plus VAT exemptions, customs benefits, and long-term land leases.

Yes, but investors must account for regulatory gaps by securing contractual protections and aligning with ESG standards.

The tournament is expected to accelerate urban renewal, create jobs, attract FDI, and cement Morocco as a regional trade and energy hub.

Launch your smart building materials business in Morocco! Leverage the growing demand for innovative, sustainable construction solutions.