Address: Front office : Twin Centre Tower A 6th floor Corner boulevard zerktouni and boulevard El Massira Casablanca Back office : espace ghazwani, Boulevard Ifni, Casablanca

Opening hours :Mon - Fri: 9am-12.30pm and 2pm-6pm Sat: 9am-12pm

Address: Front office : Twin Centre Tower A 6th floor Corner boulevard zerktouni and boulevard El Massira Casablanca Back office : espace ghazwani, Boulevard Ifni, Casablanca

Opening hours :Mon - Fri: 9am-12.30pm and 2pm-6pm Sat: 9am-12pm

Starting a business in Morocco requires selecting an appropriate legal structure such as a SARL, SA, SAS, or a Branch office. The next steps involve obtaining a negative certificate, signing a commercial lease or a domiciliation contract, opening a business bank account, and signing the articles of association.

then you need to submit the incorporation file to the regional investment center (CRI), complete legal advertising, finalize your bank account setup, and report to the Foreign Exchange Office.

Greetings, entrepreneurial mavericks, and corporate trailblazers! Are you eyeing Morocco’s vibrant markets, dreaming about the mint tea-scented air in your future office, and envisioning your business name shining bright like the Moroccan sun?

Well, pull up a chair (or a camel – we won’t judge) and get comfortable because we’ve got the ultimate treasure map for you. This guide is your secret passageway through the maze-like medinas of Moroccan company formation.

Starting a business anywhere can be a dizzying dance, but when you’re stepping onto foreign soil, it can feel more like a whirlwind in the Sahara.

Fear not, intrepid explorer, for we’re here to be your trusty compass, guiding you through each twist and turn of your Moroccan business adventure.

From untangling the threads of different business structures to negotiating the vibrant bazaar that is the regional investment center (CRI), we’ve got you covered.

Whether you’re a newbie dipping your toes into the business world or a seasoned entrepreneur looking to add another feather to your multinational cap, there’s something in here for everyone.

Keep reading if you’re ready to embark on a business journey of a lifetime. Your Moroccan business dream starts right here, and who knows, by the end of this guide, you might just be toasting to your new venture with a refreshing glass of Moroccan mint tea. Yalla, let’s dive in!

Put on your explorer hat, it’s time to dive into the wild and wonderful world of Moroccan business structures.

Just as every adventurer needs the right vehicle for their journey, every business needs the right structure to thrive. So, let’s uncover the mystery behind these acronyms together!

Ah, the SARL, as beloved and traditional as couscous on a Friday afternoon. The SARL is the go-to choice for many budding entrepreneurs in Morocco. Its main ingredients are:

Beware, though! This model might not be the best fit if you’re dreaming of a public offering. The SARL is more of a close-knit family dinner than a big market festival.

If the SARL is a cozy family dinner, then the SA is the magnificent banquet. The Public Limited Company (SA) is your ticket to the big leagues, the lavish parties of the stock market. Its star features include:

But remember, with great power comes great responsibility (or in this case, more stringent regulations).

Next up, we have the SAS, the trend-setter, the game-changer. The Simplified Public Limited Company (SAS) has been turning heads with its:

But caution! The SAS can’t publicly offer its securities, so it may be more of a private soirée than a public celebration.

let’s talk about the Branch Office, the long-distance relative of your parent company. This option lets you dip your toes into Moroccan markets without diving in headfirst. Its perks include:

But don’t forget, the parent company is fully liable for its Moroccan offspring, and it might have to navigate some extra red tape in terms of reporting and management.

And voila! You’re now well-versed in the world of Moroccan business structures. Choose wisely, intrepid business adventurer, your journey has only just begun!

| Business Structure | Key Features | Minimum Capital Requirement | Shareholder Requirement | Public Offering Allowed? |

| SARL | Limited liability, Flexible management | No minimum | 2-50 | No |

| SA | Can issue bonds or shares | MAD 300,000 (or MAD 3,000,000 for public offering) | At least 5 | Yes |

| SAS | Single-shareholder feature, Flexible management | No minimum | 1 | No |

| Branch Office | Controlled by parent company | – | – | – |

Congratulations! You’ve decided on your business structure. Now, it’s time to roll up your sleeves and get your hands dirty with some bureaucracy. But don’t worry, we’ll make it as breezy as a Moroccan beach holiday.

Our first stop is the ‘Negative Certificate’. No, it’s not a pessimistic document—it’s simply a unique name for your business. Consider this as naming your first-born business baby!

The Moroccan Office of Industrial and Commercial Property (OMPIC) grants this certificate, confirming that no other company has claimed your chosen name in Morocco.

Here’s what you need to do:

Now that your business has a name, it’s time to find it a home. There are two ways to do this in Morocco:

Sign a commercial lease. This gives your business a physical presence in Morocco—a place where you can hang your sign, meet with clients, and store your goods. Just remember to check the zoning regulations before you set your heart on a location!

Enter into a domiciliation agreement. This is like getting a P.O. Box for your business. It gives you a legal address without having to rent physical space. This can be a good option if you’re running a digital business or if you’re not ready to invest in real estate just yet.

Whichever path you choose, it’s important to make this decision carefully. After all, this will be your business’s first home in Morocco!

Stay tuned, because up next, we’re opening the door to the financial considerations of your new business. Ready to dive in? Let’s go!

Let’s imagine you’re on a magic carpet ride now, soaring over the golden dunes of the Sahara and into the sparkling cityscape of Morocco’s business world. Ready? Here we go!

First on our financial tour is the grand bazaar of banking. Just like a souk brimming with colorful textiles and glimmering lanterns, your choices for a corporate bank account in Morocco are diverse and vibrant.

Setting up a corporate bank account is like setting up your very own treasure chest. This is where you’ll stash your capital, manage your transactions, and, fingers crossed, watch your profits roll in.

Here’s a simple checklist for you:

Pick a bank that suits your needs. Do some window shopping before you settle on a bank. Look at their fees, services, and the convenience of their branches and ATMs.

Gather your documents. This usually includes your Negative Certificate, a commercial lease or domiciliation agreement, and identification documents.

Deposit your initial capital. This amount will depend on the business structure you’ve chosen.

With that done, you’re now the proud owner of a Moroccan corporate bank account. Congratulations!

Now, let’s talk about the bedrock of your business—your Articles of Association. Think of this as the rule book for your company, a charter that dictates how your business will run.

Creating the Articles of Association is like weaving a Moroccan carpet—every thread counts. They will contain:

Once these Articles are signed, sealed, and delivered, your business is one step closer to coming alive.

There you have it! You’ve navigated the bustling market of financial considerations. Up next, we’re heading into the maze of legal and regulatory procedures. But fear not, we’ve got a map! Ready to take the next step on your Moroccan business adventure? Onwards we go!

Strap in, adventurous entrepreneurs, as we embark on the rollercoaster ride of Morocco company formation. As we start a business in Morocco, legal structures such as LLC, PLC, SAS, and Branch Office become crucial.

These steps to create a company might seem like a dizzying maze, but don’t worry—we’re here to navigate it together.

Incorporating a company in Morocco, whether it’s a Limited Liability Company (SARL) with its non-free transferability of shares and founding partners or a Public Limited Company (SA) with its free transfer of shares, means dealing with a lot of paperwork.

Once your trade name registration has been cleared with your negative certificate from the Moroccan Office of Industrial and Commercial Property and your business bank account is set up with a certificate of capital freezing, it’s time to prepare your constitutive documents.

This includes your articles of association, which are like the DNA of your company. Drafting articles of association with care is as important as choosing the perfect tagine spices.

Now, it’s time to submit your incorporation file to the regional investment center (CRI). This is like sending your business on its first day of school—it’s a big step!

Remember the thrill of picking up a graded exam? That’s the feeling you’ll get when you’re withdrawing your incorporation file from the CRI. You’ll receive documents issued by the CRI that formalize your business, much like a report card formalizes your academic efforts.

With your company incorporated, it’s time to let the world know about your new business baby. Legal advertising is your business’s debutante ball—it’s the first introduction of your business to the Moroccan market.

After your legal advertising is complete, it’s time to finalize your business bank account setup. Following that, it’s essential to report to the Foreign Exchange Office, particularly if you’re planning any transfer of dividends.

As we conclude this part of your Morocco company formation journey, don’t forget the practical tips for your business venture, such as understanding the legal, social security, taxation implications, and intellectual property aspects for local trademark protection.

And remember, having an English-speaking advisor can be extremely beneficial for understanding these complex processes.

Whew! That was a thrilling ride, wasn’t it? But hold on to your hats, entrepreneurs, the journey of setting up your business in Morocco isn’t over just yet!

We’ve journeyed through the bustling bazaars of bureaucracy, climbed the mountains of Morocco company formation, and sailed the seas of start a business in Morocco process.

Now, it’s time to plant the flag at the summit and claim victory. Welcome to the final stages of setting up your business in Morocco.

Your business bank account, that treasure chest we’ve talked about, is nearly ready to start its job. To finalize your business bank account setup, you’ll need to deposit the initial capital stated in your articles of association.

The bank will then provide you with a certificate of capital freezing which proves that your business has the required funds.

But don’t be alarmed by the term ‘capital freezing’. This is just the bank’s way of saying they’ve set aside your money for your business. Like a camel carrying your precious cargo across the desert, your capital is safe and secure.

Once your business is fully set up, it’s time to make your grand announcement to the Foreign Exchange Office. This isn’t just about bragging rights, but also ensuring the necessary regulatory bodies know about your business’s existence.

The Foreign Exchange Office, like the wise gatekeeper of Moroccan finance, will help monitor your business’s international transactions. If you plan to transfer dividends or conduct other foreign operations, this step is crucial.

Congratulations, you’ve navigated the twists and turns of the journey to start a business in Morocco. But remember, this is just the beginning. As you venture into the vibrant landscape of Moroccan commerce, remember the steps to create a company, the details of company incorporation, and the nuances of legal structures like LLC, PLC, SAS, and Branch office.

And don’t forget, just as a Moroccan mint tea is best enjoyed with friends, building a business is best done with good advice and support. So, go forth, brave entrepreneur, and make your mark on the Moroccan business scene!

Just like the breathtaking final stretch of a Moroccan desert safari, we’re nearing the end of our Morocco company formation journey.

As you start a business in Morocco, wrapping up these final steps is like watching the sun set over the Sahara—beautiful, fulfilling, and a sign of great adventures to come.

Congratulations on setting up your business bank account! Now, just a bit of paperwork stands between you and a fully operational account.

Think of finalizing your business bank account as adding the final touches to a Moroccan tea ceremony. It requires precision and care, but the reward is well worth the effort.

Here’s your checklist:

With these steps completed, your business bank account is now ready to power your ventures!

Now, it’s time for the grand finale—reporting to the Foreign Exchange Office. This is the curtain call on your Morocco company formation journey.

This mandatory reporting is critical if you’re an entrepreneur planning to transfer dividends outside of Morocco. It’s your way of saying to the authorities, “Hey, we’re playing by the rules!”

And just like that, you’ve completed the final steps of establishing your business in Morocco!

Starting a business in Morocco might seem like assembling a puzzle, but with each piece—LLC, PLC, SAS, Branch Office, obtaining the Negative Certificate, signing the Articles of Association, and completing the legal and regulatory procedures—you create a beautiful picture of your company.

Congratulations, adventurer! Your Moroccan business is now ready to ride the winds of the market. But remember, every market day brings new opportunities and challenges, so stay tuned for more practical tips and guidance. Welcome to the bustling souk of Moroccan business!

As we continue our enchanting journey through the wonderland of Morocco company formation, we step into a garden of further reading and resources. Here, the fruits of knowledge about EBITDA, Income Statement, and Balance Sheet are ripe for picking. So, grab your basket and let’s get picking!

EBITDA, or Earnings Before Interest, Taxes, Depreciation, and Amortization, is like the main course at this feast. As we dive into the world of SARL, SA, and SAS shareholders, understanding EBITDA can be as essential as knowing how to negotiate in a bustling Moroccan market.

EBITDA gives a clear picture of a company’s operational profitability, regardless of its financial and tax structures.

Next, we come to the Income Statement, a crucial document whether you’re running an LLC, PLC, SAS, or a Branch Office in Morocco. Imagine the Income Statement as your business’s health check-up report. It outlines your revenues, costs, and expenses to reveal your net profit or loss.

Just like how a potter in Morocco would assess the quality of his clay, you should know how to read and interpret your income statement—it’s a vital part of the process of incorporating a company.

Last, but certainly not least, let’s decode the balance sheet. If your company were a camel, the balance sheet would be how you assess its health and load-bearing capacity.

A balance sheet gives you a snapshot of your company’s financial health, showing what your company owns (assets) and owes (liabilities), along with the share capital invested by the shareholders.

This is particularly important for steps to create a company in Morocco, as it helps to understand where your company stands financially.

There you have it, folks, a tantalizing trio of further reading for every aspiring entrepreneur wanting to start a business in Morocco. Remember, knowledge is the magic carpet that can take you to new heights in your business journey. So, keep learning, keep growing, and keep reaching for the stars!

Stick around for our final act, where we pull back the curtain on how we’re revolutionizing accounting services in Morocco. It’s going to be a showstopper!

And now, we take a detour from the beaten track of Morocco company formation to a path less trodden, one that’s just as crucial for your business: Accounting. Welcome to the exotic realm of numbers, spreadsheets, and fiscal acumen!Bh Adviser:Tax And Legal Consulting Firm In Morocco

Our mission is to transform the desert of complex figures and legal structures into a lush oasis of simplicity and clarity. As we pioneer the future of accounting services in Morocco, our vision is to empower every entrepreneur to navigate the financial landscape with ease and confidence.

Whether you’re a SAS shareholder puzzling over your minimum share capital for SAS, an LLC Director considering the need for an auditor for LLC, or you’re just trying to grasp the implications of non-free transferability of shares in your SARL, our goal is to illuminate your path.

We envision a future where every business, big or small, from LLC to PLC, can operate with financial transparency and robustness. We believe that understanding the complexities of your balance sheet and income statement should be as enjoyable as a stroll through the vibrant streets of Marrakech.

Think of us as your English-speaking advisor, guiding you through the maze of company incorporation, from securing your negative certificate to drafting your articles of association.

Need help with your regional investment center (CRI) interactions?We’re here. Struggling with legal advertising or navigating the foreign exchange office requirements? We’ve got your back.

But we’re more than just an accounting service. We’re your business’s trusted companion on this Moroccan adventure. So don’t be a stranger—reach out!

If you’re ready to revolutionize the way you handle your business’s finances in Morocco, you know what to do. Get in touch, and let’s embark on this journey together.

Hold on tight, intrepid entrepreneurs. We’re just getting started!

Ready to turn your Moroccan business dream into a reality? We’re here to help! Reach out to us for personalized guidance, support, and answers to all your queries. Let’s make your entrepreneurial journey in Morocco a resounding success together.

The cost to set up a company in Morocco can vary significantly, depending on the business structure and legal fees

The initial capital needed to start a business in Morocco varies by business type.

Yes, foreigners can fully own a business in Morocco, with certain exceptions in sectors such as agriculture.

Starting a business in Morocco involves navigating regulatory requirements, but with the right guidance, the process can be straightforward.

To register a business in Morocco, you need to choose a business structure, obtain a negative certificate, sign a commercial lease, open a business bank account, sign the articles of association, and submit the incorporation file to the CRI.

The process to register a company in Morocco can typically take between tow to three weeks.

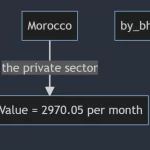

in September 2023, the minimum wage in Morocco was approximately MAD 2970.05 per month for the private sector.

The average monthly salary in Morocco is around MAD 5,500, though this varies widely across professions and regions.

To start an LLC in Morocco, you must choose a company name, define the business structure, secure a commercial lease, open a business bank account, draft and sign articles of association, and submit the incorporation file to the CRI.

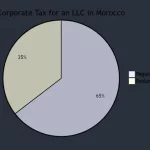

The corporate tax for an LLC in Morocco is typically 31%, with a reduced rate of 17% for the first five years for companies exporting goods or services.

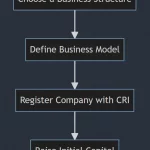

Starting a startup in Morocco involves choosing a business structure, defining your business model, registering your company with the CRI, and raising initial capital.

Yes, VAT paid on purchases and expenses related to a company’s business activities is generally refundable in Morocco.

the biggest company in Morocco by market cap was Itissalat Al-Maghrib, a major telecoms company.

The standard corporate tax rate in Morocco is 31%, with varying rates for specific sectors and depending on the size of the company.

The standard VAT rate in Morocco is 20%, but rates can vary between 7% to 14% for specific goods and services.

he average salary in Morocco is around MAD 5,500 per month, but this can vary significantly depending on the profession, qualifications, and region.

Taxes in Morocco are paid to the Tax Department of the Ministry of Economy and Finance, either directly

The process of setting up a business in Morocco involves a number of administrative and legal steps, but can be navigated effectively with the right guidance.

The cost to establish a company in Morocco can vary depending on the business structure and associated legal fees.

Morocco welcomes foreign investment and allows foreigners to fully own a business, with a few sector-specific exceptions.

It’s crucial to select an appropriate business structure (e.g., LLC, PLC, SAS), as each has different legal, operational, and financial implications.

Registering a company requires obtaining a negative certificate, signing a commercial lease, opening a business bank account, and submitting the incorporation file to the Regional Investment Center (CRI).

Taxes in Morocco can vary based on the type and size of the business. VAT paid on business-related purchases and expenses is generally refundable.

The average monthly salary in Morocco is around MAD 5,500, though this can significantly differ across sectors and regions.

With continual improvements in its business environment and regulatory reforms, Morocco presents a promising landscape for entrepreneurs and investors.

And there we have it! From understanding the distinct business structures to navigating the regulatory requirements, we’ve walked the winding and exciting path of starting a business in Morocco together. It’s certainly a journey, filled with a unique blend of challenges and opportunities that make the entrepreneurial experience all the more rewarding.

The beauty of it all is that Morocco, with its strategic location, growing economy, and welcoming business environment, offers a wonderful canvas for your entrepreneurial dreams. Whether it’s a charming café in Marrakech or a cutting-edge tech startup in Casablanca, the opportunities are as diverse and vibrant as the country itself.

So, don’t let the bureaucratic details scare you away. With this guide in hand, and perhaps a cup of traditional Moroccan mint tea, you’re well-equipped to bring your business idea to life in the enchanting landscape of Morocco.

Thank you for joining us on this journey. Here’s to the remarkable adventure of entrepreneurship that lies ahead in Morocco. Remember, every great business starts with that first bold step. We hope that our guide has not only provided valuable insights but also sparked the same excitement in you that the world of business in Morocco holds for us.

Shukran (Thank you in Arabic) for staying with us through this comprehensive exploration. We can’t wait to see what you’ll build in Morocco!