Address: Front office : Twin Centre Tower A 6th floor Corner boulevard zerktouni and boulevard El Massira Casablanca Back office : espace ghazwani, Boulevard Ifni, Casablanca

Opening hours :Mon - Fri: 9am-12.30pm and 2pm-6pm Sat: 9am-12pm

16.01.2023 | Bh Adviser | Morocco

Rate this article

6/ ( 57 votes )

If you are a Moroccan living abroad and you need information on taxation in Morocco, we recommend that you attend the open days organised by the Directorate General of Taxes during the months of July and August each year. These meetings take place on their premises and aim to provide information on Moroccan taxation as well as on all the measures taken by the State to facilitate the economic reintegration of MREs. A telephone information centre has also been set up on 05 37 27 37 27.

The reduced registration duty rate of 4% is applicable to any holder of real estate for residential, commercial, professional, or administrative use.

Credit institutions or similar bodies holding premises used for commercial or financial purposes under a “Murabaha”, “Ijara Mountahia Bitamlik” or “Moucharaka Moutanakissa” contract also benefit from the rate. Similarly, all land on which these premises are built is subject to the 4% rate.

The 3% rate is applicable to the first sale of social housing and housing with low property value.

The application for a release of mortgage concerns owners of social housing who have granted a first or second mortgage to the state. You can obtain the release by applying to the tax authorities in your place provided that the following documents are available:

Read more : 7 Best Places to Start Your Business in Morocco

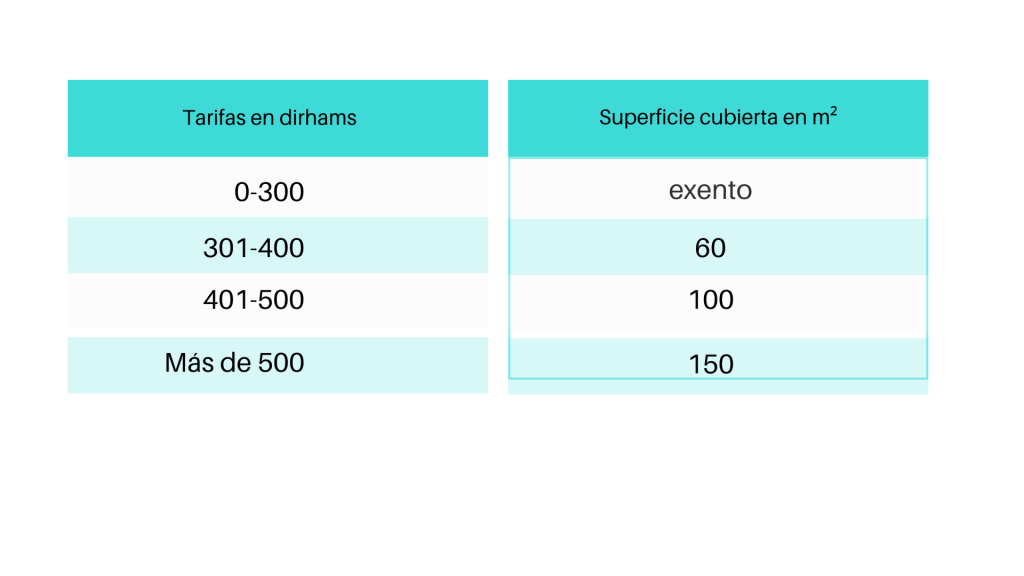

The social solidarity contribution concerns housing units with a surface area of less than 300m².

If the surface area exceeds 300m², the owner of the dwelling is liable to pay the contribution on the entire surface area covered.

A scale is established to determine the amount of the social solidarity contribution on self-deliveries of residential construction.

Your announcement has to be made on a shape to the tax collector for your locality at an identical time because of the payment.

You have to upload the files that allow living, the floor region protected, and the applicable contribution.

The closing date for filing the announcement is ninety days from the date of difficulty of the housing allowance.

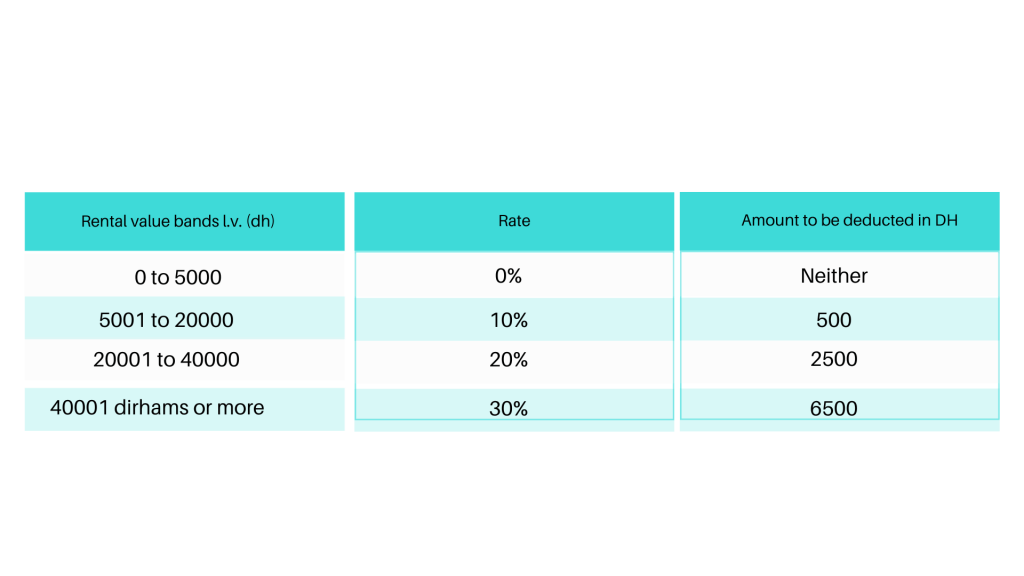

Council tax applies to main and secondary dwellings. This tax is based on the rental value of the dwelling and is determined by the census commission. The rental value of housing is increased by 2% every 5 years.

Any Moroccan living abroad benefits from an abatement of 75% of the rental value. This abatement concerns the main dwellings. And concerning the housing tax, you are exempted for 5 years.

To give you a clearer idea of the scale, here is a summary table:

It should also be noted that the MRE has certain obligations in terms of housing tax:

He is obliged to declare the end of the construction work for all constructions or additions. This declaration must be made no later than 31 January of the year following the end of the work. Any change of ownership or use of buildings must also be declared by 31 January of the year following the change.

Another declaration must also be made for any owner or usufructuary of buildings that are already subject to council tax. If your dwellings are vacant or undergoing major repairs, you must file a vacancy declaration specifying the reason for the vacancy.

The municipal services tax applies to buildings, regardless of their purpose. If the building is used as a main residence, the owner benefits from a 75% reduction in the rental value.

The applicable rates are as follows:

Premises located in urban municipalities, delimited centres and resorts are subject to a rate of 10.50% of the rental value.

Premises located within urban municipalities are subject to a rate of 6.50% of the rental value.

Foreigners who have decided to settle in Morocco benefit from an allowance of 60% or 40% on their pension, depending on the case, and a reduction of 80% of the amount of tax. However, for these benefits to apply, the pension must be transferred to Morocco permanently and in dirhams. We also remind you that the transfer must be made in non-convertible dirhams. It is also important to file the previous year’s income tax return and pay electronically.

You are subject to income tax on any income earned from renting out a home or making it available free of charge to third parties. However, the amount of gross annual property income that does not exceed 30,000 dirhams is exempt from income tax.

Rates of earnings tax implemented to assets earnings:

The assertion of the IR ought to be completed earlier than the third month of every consecutive yr, consequently earlier than March following the yr wherein the earnings become acquired. We additionally remind you that the assertion ought to be made with the aid of using digital means, indicating

In the case of the disposal of land, income tax applies to the land proceeds acquired. However, an exemption applies in the case where the land profit has been realised on the disposal of a building that has been occupied as a dwelling for more than six months. Similarly, an exemption applies if the value of the property transfers does not exceed 140 000 DHS in the calendar year. This exemption also applies to the disposal of buildings or parts of buildings that have been acquired by way of “Ijara Mountahia Bitamlik”.

A rate of 20% is applied to the profit made on the disposal of real estate. However, the property must have been built before the period for granting the exemption expired. A minimum rate is also applied in the absence of profit and is worth 3% of the transfer price for all transfers exceeding 4 million dirhams.

A rate of 20% is applied to the profit made on the disposal of real estate. However, the property must have been built before the period for granting the exemption expired. A minimum rate is also applied in the absence of profit and is worth 3% of the transfer price for all transfers exceeding 4 million dirhams.

To benefit from this refund, the purchase must meet certain criteria:

All goods and merchandise purchased must leave Morocco within three months of purchase and must be in the buyer’s luggage.

It is also imperative to fill in an export sales note (1 original copy + 3 copies) at the time of purchase, which will allow it to cross the borders. A tax administration form must also be filled out and accompanied by the purchase invoices which mention all the legal information on the seller.

Once all the formalities have been complied with at the border, the administration will refund the VAT by bank transfer, deducting the transfer costs.