Address: Front office : Twin Centre Tower A 6th floor Corner boulevard zerktouni and boulevard El Massira Casablanca Back office : espace ghazwani, Boulevard Ifni, Casablanca

Opening hours :Mon - Fri: 9am-12.30pm and 2pm-6pm Sat: 9am-12pm

Address: Front office : Twin Centre Tower A 6th floor Corner boulevard zerktouni and boulevard El Massira Casablanca Back office : espace ghazwani, Boulevard Ifni, Casablanca

Opening hours :Mon - Fri: 9am-12.30pm and 2pm-6pm Sat: 9am-12pm

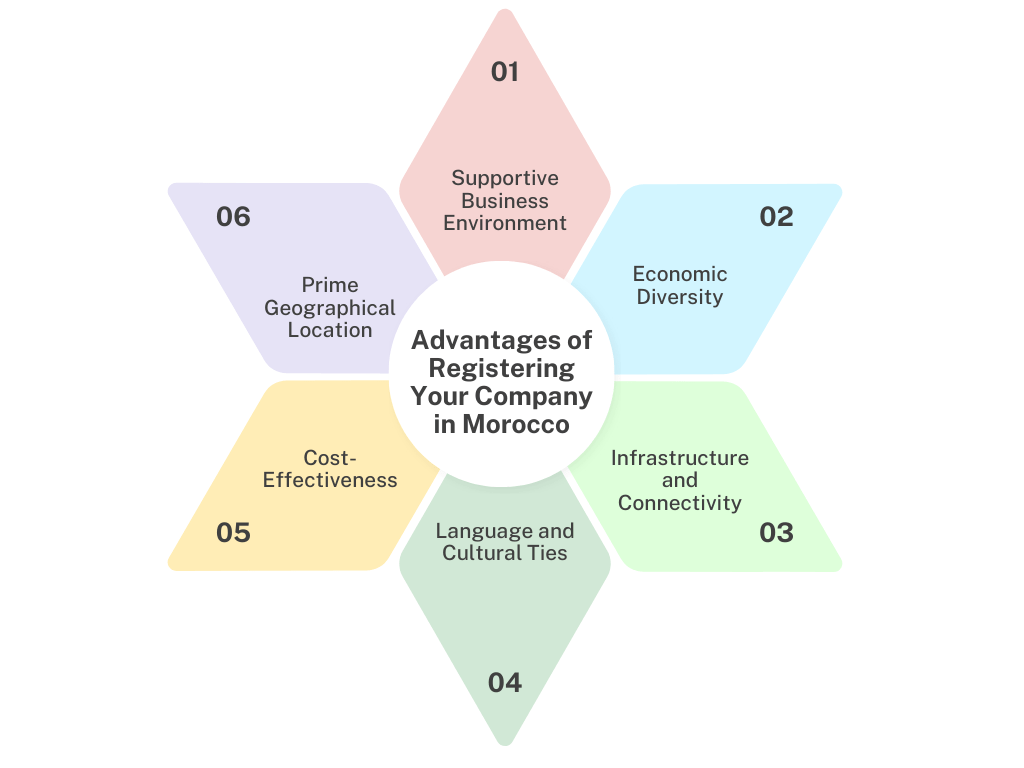

Over the last decade, Morocco’s economy has flourished, establishing itself as an attractive hub for global investors and entrepreneurs. The Moroccan government has actively encouraged business startups through appealing tax incentives, enhancing the ease of company registration in Morocco.

The process for setting up an organization in Morocco, including the Morocco Company Registration Procedure and obtaining a Morocco Business License, has been streamlined, requiring only two days for submitting an incorporation application. This, coupled with a low inflation rate, positions Morocco as an ideal location for business ventures.

Notably, significant investments like Renault’s $1.5 billion manufacturing unit showcase Morocco’s growing industrial capacity. For entrepreneurs looking to navigate the landscape of Moroccan Business Entities, understanding the nuances of Limited Liability Company SARL, Morocco Tax Identification, and Corporate Bank Account requirements is vital. Additionally, familiarizing oneself with the Morocco Chamber of Commerce, Morocco Registration Certificate, and Negative Certificate Morocco is essential for compliance with local regulations.

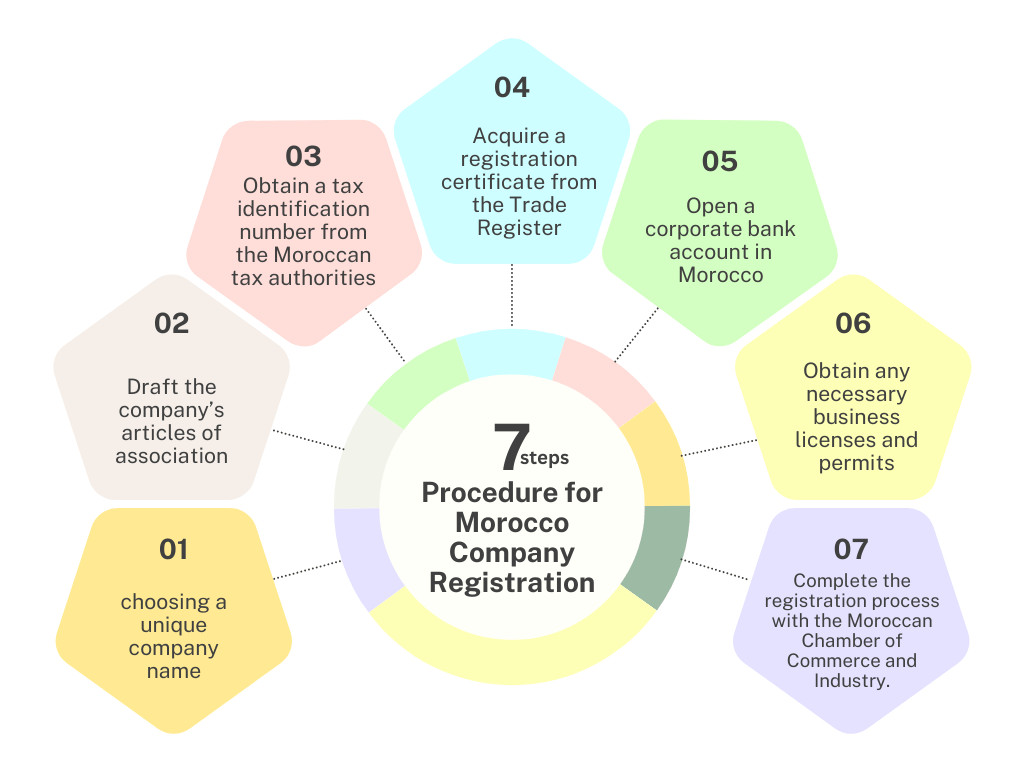

Registering a company in Morocco is a straightforward process. It involves following a few clear steps:

Once you complete the company registration process in Morocco, you’re ready to begin business operations.

Necessary documents for company registration in Morocco include:

The documents needed for registering a company can vary based on the company type and industry. Our team of experts can assist you through the process to minimize any mistakes.

In Morocco, you can choose from the following common business entity types when registering a company:

The most common entities are:

| Business Entity Type | Description | Minimum Shareholders | Minimum Capital |

|---|---|---|---|

| Limited Liability Company (SA) | Requires at least five shareholders, either individuals or legal entities. Shareholders’ losses are limited to their share equity. | 5 | Not specified |

| Private Limited Company (SARL) | An intermediate form of business, requiring a detailed memorandum of agreement and described capital stock. | Not specified | 10,000 MAD |

| Branch Office | A separate legal entity affiliated with a foreign company, must provide detailed information about the parent company. | Not applicable | Not applicable |

| Sole Proprietorship | For foreigners, run by an individual responsible for all company obligations. Requires registration with Commerce Registry and tax authority. | 1 (individual) | Not applicable |

There are various taxes that companies must pay in Morocco :

For accurate estimates, consulting with business experts like BH Adviser.

When considering registering a company in Morocco, investors should understand the legal steps, global rules, and necessary investment for success. Morocco’s Tanger-Med port is a major gateway to Europe, offering good return opportunities for traders.

Knowing the social, cultural, and political environment is key to a business’s success. While the registration process can be complex, professional guidance, such as from BH Adviser, can ease the process.

Setting up a limited liability company (LLC) in Morocco depending on includes fees for company registration, opening a bank account, legal address listing, and other administrative costs.

Numerous business opportunities exist in Morocco, and the government consistently extends its support to new ventures.

Individuals linked to the country or permanent residents who have lived there for a specified period can be granted permission through naturalization.

Foreign income earned by a Moroccan citizen is taxable in Morocco, unless exempted by a specific treaty.

Moroccan tax residents must pay personal income tax on their global earnings, while non-residents are taxed only on income sourced from Morocco.