Address: Front office : Twin Centre Tower A 6th floor Corner boulevard zerktouni and boulevard El Massira Casablanca Back office : espace ghazwani, Boulevard Ifni, Casablanca

Opening hours :Mon - Fri: 9am-12.30pm and 2pm-6pm Sat: 9am-12pm

Rate this article

6/ (99 votes )

Morocco’s increasing economy and position make it a desirable place for people and companies hoping to spread. In this Morocco business guide, we will go through all you have to know concerning initiating a business in Morocco, handling the Moroccan business ecosystem, and utilizing chances for growth.

Morocco is a North African country with a population of over 40 million. It has a diversified economy with several sectors contributing to its GDP, such as agriculture, industry, and services. According to the World Bank, Morocco’s GDP was $120.3 billion in 2020, and its GDP per capita was $3,222.

Morocco ranks 53rd out of 190 economies in terms of ease of doing business( In the World Bank’s “Doing Business 2023” report)

Morocco has ranked ahead of several other African countries, including Algeria, Egypt, and Nigeria. The report also highlighted some areas of improvement, such as enforcing contracts, getting electricity, and dealing with construction permits.

Starting a business in Morocco can be challenging, especially if you are unfamiliar with the local regulations and customs. In this article, we’ll cover everything you need to know about starting a business in Morocco, including the various forms of company structures, tax, administration, and if you require a visa.

When setup business in morocco, choosing the right legal structure is crucial as it will determine the liability, taxation, and management of your business. Here is an overview of the main company structures in Morocco, along with a table comparing their key features:

A Sole Proprietorship (Entreprise individuelle) is one of the simplest and most common forms of business structure in Morocco. It is suitable for small businesses and individual entrepreneurs who want to establish their business with minimal legal formalities and start-up costs. Here are the main features of a Sole Proprietorship in Morocco:

The owner of a Sole Proprietorship has unlimited liability, meaning they are personally responsible for all debts and obligations of the business. Their personal assets can be seized to cover the company's debts.

A Sole Proprietorship must be registered with the Central Register of Commerce (CRI) by obtaining a unique registration number (ICE). The owner must also register the business with the tax authorities and social security administration.

here is no minimum capital requirement for establishing a Sole Proprietorship in Morocco.

A Sole Proprietorship is owned and managed by a single individual. The owner is responsible for making all business decisions and may also employ others to assist with the day-to-day operations.

Sole Proprietorships are subject to individual income tax based on the owner's net income from the business. The owner is also responsible for withholding and remitting payroll taxes and social security contributions on behalf of their employees.

Sole Proprietorships must maintain proper accounting records and submit annual financial statements to the tax authorities. However, the reporting requirements for Sole Proprietorships are generally less stringent than those for other legal structures, such as Limited Liability Companies (SARLs) or Joint Stock Companies (SAs).

A Sole Proprietorship can be dissolved when the owner decides to cease operations or upon their death. The business assets and liabilities are then transferred to the owner's estate.

a Sole Proprietorship in Morocco is a simple and cost-effective way for individuals to start their own business. However, the unlimited liability of the owner may be a significant drawback for some entrepreneurs, especially if the business carries substantial risks or financial obligations.

A Limited Liability Company (Société à Responsabilité Limitée, SARL) is a popular form of business structure in Morocco, offering limited liability protection to its owners and a flexible management structure. It is suitable for small to medium-sized businesses and is widely used by both local and foreign investors. Here are the main features of a SARL in Morocco:

The shareholders of a SARL have limited liability, meaning their personal assets are protected from the company's debts and obligations. Their liability is limited to the extent of their capital contribution to the company.

A SARL must be registered with the Central Register of Commerce (CRI) and obtain a unique registration number (ICE). The company is also required to register with the tax authorities and social security administration.

The minimum capital requirement for a SARL in Morocco is 10,000 MAD, which must be fully subscribed and paid up at the time of incorporation. The capital is divided into shares, and the value of each share cannot be less than 10 MAD.

A SARL requires at least two shareholders and can have up to 50 shareholders. Shareholders can be individuals or legal entities, and there is no requirement for them to be Moroccan residents.

A SARL is managed by one or more managers (gérants) appointed by the shareholders. Managers can be shareholders or third parties, and there is no requirement for them to be Moroccan residents.

SARLs must maintain proper accounting records and prepare annual financial statements, which must be audited by a certified public accountant if the company exceeds certain size thresholds or operates in specific sectors. SARLs are also required to hold an annual general meeting (AGM) to approve the financial statements and discuss other important matters.

SARLs in Morocco are subject to Corporate Income Tax (CIT) based on their taxable income. They are also required to withhold taxes on certain payments, such as dividends and service fees, and are responsible for withholding and remitting payroll taxes and social security contributions on behalf of their employees.

A SARL can be dissolved for various reasons, such as the expiration of its term, the accomplishment of its purpose, or the decision of its shareholders. The dissolution process involves liquidating the company's assets, settling its debts and obligations, and distributing any remaining assets to the shareholders.

SARL in Morocco is a flexible and widely used business structure, offering limited liability protection to its owners and allowing for relatively simple management arrangements. It is a popular choice for both local and foreign entrepreneurs looking to set up a business in Morocco.

A Joint Stock Company (Société Anonyme, SA) is a popular form of business structure in Morocco, particularly for large businesses and those seeking to raise capital through public offerings. It offers limited liability protection to its shareholders and has a more structured management and governance system compared to other company types. Here are the main features of an SA in Morocco:

Shareholders of an SA have limited liability, meaning their personal assets are protected from the company's debts and obligations. Their liability is limited to the extent of their capital contribution to the company.

An SA must be registered with the Central Register of Commerce (CRI) and obtain a unique registration number (ICE). The company is also required to register with the tax authorities and social security administration.

The minimum capital requirement for an SA in Morocco is 300,000 MAD for non-publicly traded companies and 3,000,000 MAD for publicly traded companies. At least one-quarter of the capital must be paid up at the time of incorporation.

An SA is managed by a Board of Directors composed of at least three members and a maximum of twelve members, elected by the shareholders. The Board of Directors appoints a Chairman, who represents the company and ensures the implementation of the Board's decisions. Additionally, the Board of Directors appoints a General Manager responsible for the day-to-day management of the company.

An SA must also have a Supervisory Board to monitor the management of the company and the accuracy of the financial statements. The Supervisory Board is composed of at least three members, elected by the shareholders.

SAs must maintain proper accounting records and prepare annual financial statements, which must be audited by a certified public accountant. SAs are required to hold an annual general meeting (AGM) to approve the financial statements, elect members of the Board of Directors and the Supervisory Board, and discuss other important matters.

As in Morocco are subject to Corporate Income Tax (CIT) based on their taxable income. They are also required to withhold taxes on certain payments, such as dividends and service fees, and are responsible for withholding and remitting payroll taxes and social security contributions on behalf of their employees.

An SA can be dissolved for various reasons, such as the expiration of its term, the accomplishment of its purpose, or the decision of its shareholders. The dissolution process involves liquidating the company's assets, settling its debts and obligations, and distributing any remaining assets to the shareholders.

A Joint Stock Company (Société Anonyme, SA) in Morocco is well-suited for large businesses and those seeking to raise capital through public offerings. It offers a structured management and governance system, along with limited liability protection for its shareholders. However, it may not be the best choice for smaller businesses due to its higher capital requirements and more complex regulatory and reporting requirements.

A Simplified Joint Stock Company (Société par Actions Simplifiée, SAS) is a relatively recent addition to the available company structures in Morocco. It offers flexibility in management and organization, along with limited liability protection to its shareholders. The SAS is suitable for businesses of all sizes and is particularly popular among foreign investors and joint ventures. Here are the main features of an SAS in Morocco:

Shareholders of an SAS have limited liability, meaning their personal assets are protected from the company's debts and obligations. Their liability is limited to the extent of their capital contribution to the company.

An SAS must be registered with the Central Register of Commerce (CRI) and obtain a unique registration number (ICE). The company is also required to register with the tax authorities and social security administration.

The minimum capital requirement for an SAS in Morocco is 100,000 MAD, with at least one-quarter of the capital paid up at the time of incorporation

An SAS requires at least two shareholders, with no maximum limit. Shareholders can be individuals or legal entities, and there is no requirement for them to be Moroccan residents.

An SAS is managed by a President, who is responsible for the day-to-day management of the company and represents it in legal matters. The President can be a shareholder or a third party, and there is no requirement for them to be a Moroccan resident. Additionally, an SAS may choose to appoint a Board of Directors to assist with the management and governance of the company.

SASs must maintain proper accounting records and prepare annual financial statements. They may be subject to an audit by a certified public accountant, depending on the company's size and sector. SASs are also required to hold an annual general meeting (AGM) to approve the financial statements and discuss other important matters.

SASs in Morocco are subject to Corporate Income Tax (CIT) based on their taxable income. They are also required to withhold taxes on certain payments, such as dividends and service fees, and are responsible for withholding and remitting payroll taxes and social security contributions on behalf of their employees.

An SAS can be dissolved for various reasons, such as the expiration of its term, the accomplishment of its purpose, or the decision of its shareholders. The dissolution process involves liquidating the company's assets, settling its debts and obligations, and distributing any remaining assets to the shareholders.

a Simplified Joint Stock Company (Société par Actions Simplifiée, SAS) in Morocco is an attractive option for businesses seeking flexibility in management and organization, along with limited liability protection for its shareholders. It is particularly popular among foreign investors and joint ventures, as it offers a simpler and more adaptable structure compared to a traditional Joint Stock Company (Société Anonyme, SA).

A Partnerships (Société en Nom Collectif, SNC) is a type of business structure in Morocco that involves two or more individuals or legal entities joining together to carry on a business under a common name. SNCs are less common than other forms of business structures, such as SARLs and SAs, due to their unlimited liability for the partners. Here are the main features of an SNC in Morocco:

Partners of an SNC have unlimited liability, meaning their personal assets are at risk if the company's debts and obligations cannot be met. Each partner is jointly and severally liable for the partnership's debts, regardless of their individual contribution to the business.

An SNC must be registered with the Central Register of Commerce (CRI) and obtain a unique registration number (ICE). The partnership is also required to register with the tax authorities and social security administration.

There is no minimum capital requirement for establishing an SNC in Morocco. However, partners are required to make contributions in cash, kind, or services, as specified in the partnership agreement.

An SNC requires at least two partners, who can be individuals or legal entities. There is no maximum limit on the number of partners, and there is no requirement for them to be Moroccan residents.

The management of an SNC is typically handled by one or more partners, known as managing partners, who are appointed by the partnership agreement. The managing partners have the authority to make decisions on behalf of the partnership and represent it in legal matters.

SNCs must maintain proper accounting records and submit annual financial statements to the tax authorities. The reporting requirements for SNCs are generally less stringent than those for other legal structures, such as SARLs or SAs.

SNCs in Morocco are not subject to corporate income tax. Instead, the partners are individually taxed on their share of the partnership's profits, which are reported as personal income. The partnership is responsible for withholding and remitting payroll taxes and social security contributions on behalf of its employees.

An SNC can be dissolved for various reasons, such as the expiration of its term, the accomplishment of its purpose, the death or withdrawal of a partner, or the decision of the partners. The dissolution process involves settling the partnership's debts and obligations, and distributing any remaining assets among the partners according to their respective shares in the partnership.

a Partnership (Société en Nom Collectif, SNC) in Morocco is a relatively simple and flexible business structure that allows partners to pool their resources and expertise. However, the unlimited liability of the partners may be a significant drawback for some entrepreneurs, making it less suitable for high-risk businesses or those with substantial financial obligations.

A partnership (Société en Nom Collectif, SNC) is a type of business structure in Morocco that involves two or more individuals or legal entities joining together to carry on a business under a common name. SNCs are less common than other forms of business structures, such as SARLs and SAs, due to their unlimited liability for the partners. Here are the main features of an SNC in Morocco:

Partners of an SNC have unlimited liability, meaning their personal assets are at risk if the company's debts and obligations cannot be met. Each partner is jointly and severally liable for the partnership's debts, regardless of their individual contribution to the business.

An SNC must be registered with the Central Register of Commerce (CRI) and obtain a unique registration number (ICE). The partnership is also required to register with the tax authorities and social security administration.

There is no minimum capital requirement for establishing an SNC in Morocco. However, partners are required to make contributions in cash, kind, or services, as specified in the partnership agreement.

An SNC requires at least two partners, who can be individuals or legal entities. There is no maximum limit on the number of partners, and there is no requirement for them to be Moroccan residents.

The management of an SNC is typically handled by one or more partners, known as managing partners, who are appointed by the partnership agreement. The managing partners have the authority to make decisions on behalf of the partnership and represent it in legal matters in morocco

SNCs must maintain proper accounting records and submit annual financial statements to the tax authorities. The reporting requirements for SNCs are generally less stringent than those for other legal structures, such as SARLs or SAs.

SNCs in Morocco are not subject to corporate income tax. Instead, the partners are individually taxed on their share of the partnership's profits, which are reported as personal income. The partnership is responsible for withholding and remitting payroll taxes and social security contributions on behalf of its employees.

An SNC can be dissolved for various reasons, such as the expiration of its term, the accomplishment of its purpose, the death or withdrawal of a partner, or the decision of the partners. The dissolution process involves settling the partnership’s debts and obligations, and distributing any remaining assets among the partners according to their respective shares in the partnership..

Here is a table that outlines the key characteristics of the most common company structures:

| Company Structure | Description | Liability | Capital Requirements | Formation Process | Taxation |

|---|---|---|---|---|---|

| Sole Proprietorship | A single individual owns and operates the business. | Unlimited (personal liability) | No minimum capital required | Simple and straightforward process; register with local authorities | Personal income tax |

| General Partnership | Two or more partners jointly operate a business, sharing profits and losses. | Unlimited (joint liability) | No minimum capital required | Sign partnership agreement and register with local authorities | Partners taxed on personal income |

| Limited Partnership | A partnership with one or more general partners and one or more limited partners. | General partners: unlimited (joint liability); Limited partners: limited to their capital contribution | No minimum capital required | Sign partnership agreement and register with local authorities | Partners taxed on personal income |

| Limited Liability Company (SARL) | A separate legal entity where partners’ liability is limited to their capital contributions. | Limited liability | MAD 10,000 (approx. $1,000) | Sign articles of association, register with local authorities, and obtain required licenses | Corporate tax; dividend tax for partners |

| Public Limited Company (SA) | A company with share capital divided into shares, allowing it to offer shares to the public. | Limited liability | MAD 300,000 (approx. $30,000) | Sign articles of association, register with local authorities, and obtain required licenses; public companies must also register with the stock exchange | Corporate tax; dividend tax for shareholders |

Please note that this table provides a general overview of the main company structures available in Morocco. It is important to consult with a local legal and financial expert to determine which structure is best suited for your specific business needs and circumstances.

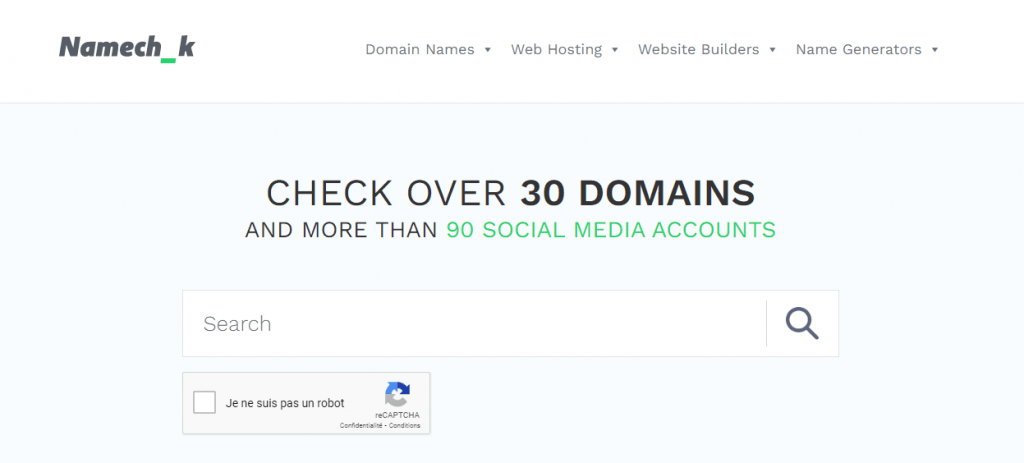

First, dodge common errors entrepreneurs make when establishing a business in Morocco, , such as using a name that isn’t unique or is already in use in Morocco, or using a trademark so that later they get receive a letter saying they infringe on someone else’s on the trademark. To prevent this from occurring, you should choose a unique company name, and ensure social media and the domain name is available.

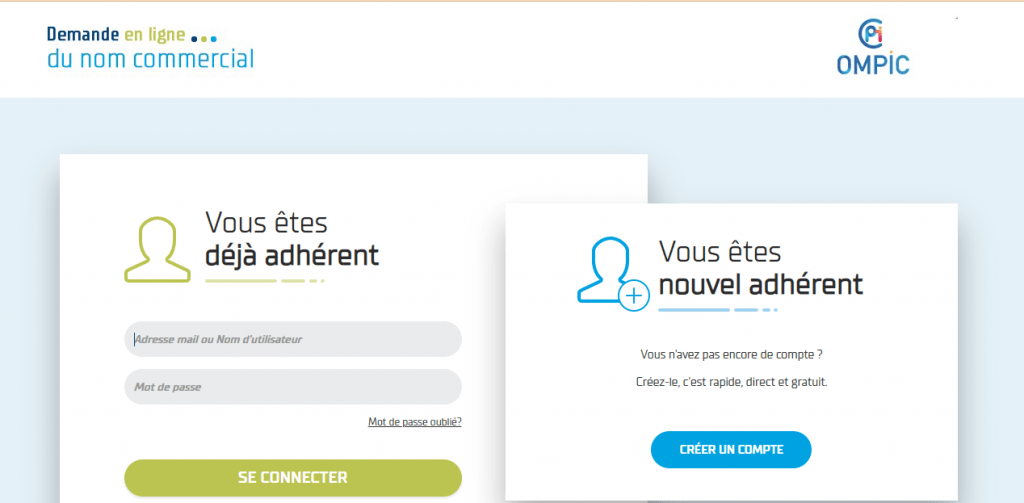

you can search ompic.org (to make sure no one uses this name in Morocco).

Nemechek ( for make sure u social media and the domain name are disponible )

you apply for the company name “negative certificate” at ompic.org :

To be registered, Moroccan businesses must provide a registered office address. There are two choices – rent premises or use a business centre. Domiciliation is the most common choice, as 72% of new companies in Casablanca use it during start-up, according to the Moroccan Association of Business Centres (AMCA).

Below is a table outlining the key aspects of signing a commercial lease and a domicile agreement in Morocco.

| Aspect | Commercial Lease | Domicile Agreement |

|---|---|---|

| Purpose | Renting a space for business operations | Establishing a legal address for the company |

| Duration | Typically 3 to 9 years, negotiable | Varies, usually based on an annual agreement |

| Rent Payment | Monthly or quarterly, as agreed upon | Monthly or annual, as agreed upon |

| Rent Increase | Usually indexed to changes in the cost of living | Typically subject to annual review and renegotiation |

| Security Deposit | Commonly required, equivalent to 2-3 months’ rent | May be required, depending on the agreement |

| Termination | Notice period specified in the lease agreement | Notice period specified in the domicile agreement |

| Maintenance & Repairs | Tenant responsible for minor repairs; landlord for major repairs | Varies, depending on the agreement |

| Use & Modifications | Limited to the agreed-upon commercial activity | Limited to establishing and maintaining a legal address |

| Sublease & Assignment | Subject to landlord’s approval | Usually not permitted |

| Taxes & Insurance | Tenant typically responsible for taxes and insurance related to the leased property | Varies, depending on the agreement |

| Legal Requirements | Lease agreement must be in writing and registered with local authorities | Domicile agreement must be in writing and registered with local authorities |

| Dispute Resolution | Negotiation, mediation, or litigation | Negotiation, mediation, or litigation |

The company’s rules are brought together in its statutes. This covers the partners’ relationship and with third parties. Specifically, outlined are:

The company's legal form (Ltd, plc, etc.) in morocco

The object of the enterprise Purpose of the business activity in morocco

The corporate name of company in Morocco

Head office (domicile or rent) in Morocco

Lifespan (normally 99 yrs)

The amount of share capital company in Morocco

Contributors' identity and capital distribution between themThe leaders (manager, CEO, etc.)

Essential company rules (increase/reduction of capital, share transfer, meetings etc.)

This document can be drawn up in two ways:

It is advised to engage a professional to draw up, in order to ward off any likely difficulties or disagreeable shocks in the commercial court and, Don’t have issues when you wish to open a company bank account in Morocco.. Use of standard models (available on the web) is not sensible. These won’t tally with the individualities of your firm and its operational pattern.

Once the drafting of the articles of association is completed, the founding partners may sign the final bylaws without being physically present in Morocco or give power of attorney to a chartered accountant

A registration form (AAC050B-20I) for Professional Tax is made and sent to the Tax Administration in Morocco (https://tax.gov.ma/wps/portal/DGI/Accueil/). This will provide a Professional Tax (TP) registration certificate with a registration number and declared occupation which will be the basis of taxation.

Gather all necessary documents, including a copy of your ID card, registration form, company documents (if applicable), and proof of address. You may also need to provide a legal representative's authorization if you are registering on behalf of a company or another individual.

After submitting your registration form, the Tax Administration will review and verify the information provided. This process may take several weeks to complete, so be prepared to wait for a response. During this time, you might be asked to provide additional documentation or clarification on specific points.

Once your registration has been approved, you will receive a Professional Tax (TP) registration certificate, which includes your registration number and declared occupation. Keep this document safe, as it serves as proof of your registration and is required for tax-related processes.

After obtaining your registration certificate, it is important to stay up to date with your tax obligations, such as filing tax declarations, paying the Professional Tax, and maintaining accurate records. The tax rate and payment deadlines will vary depending on your occupation and the size of your business.

Updates and changes: If your business circumstances change (e.g., a change in occupation, business address, or legal representative), you are required to notify the Tax Administration promptly. Depending on the changes, you might need to complete an updated registration form (AAC050B-20I) or provide additional documentation.

registering for Professional Tax (TP) in Morocco involves submitting the registration form, providing the necessary documentation, waiting for verification, receiving your registration certificate, and ensuring ongoing compliance with your tax obligations. By staying organized and informed, you can successfully navigate the TP registration process in Morocco and ensure your business remains in good standing with the Tax Administration.

To establish a company in Morocco, it must be registered in the Trade Register (RC). The court issues an excerpt from the RC containing a unique registration number as part of the process.

The necessary documents for registration in the commercial register in morocco are:

Application for registration in the commercial register in morocco

Two copies of the company's bylaws

Two copies of the lease agreement or domiciliation agreement

Professional tax certificate in morocco

Identification documents for partners and managers

In Morocco, creating a company stamp is an essential step in establishing your business’s identity. A company stamp features the business’s name, logo, and other important information and is used to authenticate official documents.

Here is an insight into the process:

Work with a graphic designer or use an online platform to create a unique and professional design for your company stamp. It should include the company name, logo, and any other relevant information, such as the registration number or address.

There are various types of company stamps available, such as self-inking stamps, pre-inked stamps, and traditional rubber stamps.

Search for a reputable stamp maker, either online or locally. Compare the services, quality, and prices of different providers before making your decision.

Provide the stamp maker with your company stamp design and any specific requirements, such as size or ink color. Confirm the details of your order and the estimated delivery time.

Once you receive your company stamp, test it to ensure it meets your expectations and accurately represents your business. If there are any issues, contact the stamp maker to address them.

Use the company stamp on official documents, such as contracts, invoices, and other legal papers, to authenticate them and maintain a professional appearance.

In Morocco, a Tax Identification Number (Numéro d’Identifiant Fiscal or IF) is crucial for businesses to comply with tax regulations and engage in various transactions. Here’s a step-by-step guide on how to obtain a Tax ID (IF) number in Morocco:

First, register your company with the Moroccan Trade Register (RC) and obtain your unique registration number.

Collect the required documents, including your company registration certificate, bylaws, lease agreement or domiciliation agreement, and identification documents for partners and managers.

Locate your local Tax Administration office, also known as the "Direction Générale des Impôts" or "Service des Impôts des Entreprises." You can find the nearest office by visiting their official website or conducting an online search.

Present the required documents at the Tax Administration office and fill out the relevant application form for obtaining a Tax ID (IF) number. The tax officer may ask for additional information, so be prepared to provide it if necessary.

Once your application is processed and approved, you will receive your Tax ID (IF) number. The processing time may vary depending on the local office's workload.

Incorporate your Tax ID (IF) number on all relevant company documents, such as invoices, contracts, and official correspondence. This is important for tax compliance and to ensure smooth business operations.

Remember to regularly file your tax returns and stay informed about any changes in tax regulations to remain compliant and avoid penalties.

In Morocco, affiliating your company with the National Social Security Fund (Caisse Nationale de Sécurité Sociale or CNSS) is a legal requirement. The CNSS provides various benefits, such as healthcare coverage, family allowances, and retirement pensions, to employees and their families. Here’s a step-by-step guide on how to affiliate your company with the CNSS in Morocco:

Locate the nearest CNSS office by visiting their official website or conducting an online search. Visit the office in person to initiate the affiliation process.

Complete the CNSS affiliation application form, providing your company's information and required documents. The CNSS staff may request additional information or clarification if needed.

Once your application is reviewed and approved, you will be granted a CNSS affiliation number. This process may take a few days to a few weeks, depending on the workload of the local office.

Following the affiliation, register your employees with the CNSS. Provide their personal information, employment contract details, and salary information. Regularly update the CNSS about any changes in your employees' information, such as new hires or terminations.

As an employer, you are required to pay monthly contributions to the CNSS on behalf of your employees. Calculate the contributions based on the applicable rates and employee salaries, and submit the payments before the specified deadlines.

Stay informed about any changes in the CNSS regulations and procedures to maintain compliance and provide the necessary benefits to your employees.

By affiliating with the CNSS and fulfilling your obligations as an employer, you contribute to the social protection of your employees and ensure a healthy and stable work environment.

transactions, and adhering to regulatory requirements. Follow these steps to open a business bank account in Morocco:

Choose a bank: Research various banks operating in Morocco and compare their services, fees, and account options to determine the best fit for your business needs. Some popular banks include Attijariwafa Bank, Banque Populaire, BMCE Bank, and Société Générale.

Collect the necessary documents: Prepare the required documents, which may include

Tax ID (IF) number

CNSS affiliation number

Identification documents for partners and managers

Company bylaws

Board resolution authorizing the opening of the account and appointing authorized signatories

Personal identification and proof of residence for authorized signatories

Contact the bank to schedule an appointment with a business account representative. During the appointment, you will discuss your company's needs, the bank's services, and the account opening process.

Fill out the bank's business account application form, providing your company's information and required documents. The bank representative may request additional information or clarification if needed.

Most banks require an initial deposit to open a business bank account. This amount varies depending on the bank and the account type. Ensure you deposit the necessary funds as part of the account opening process.

Once your application is reviewed and approved, the bank will provide you with your account details, including the account number, checkbook, and debit cards, if applicable.

If your chosen bank offers online banking services, enroll your business account to manage your company's finances remotely and access various banking services conveniently.

By opening a business bank account in Morocco, you can manage your company’s finances efficiently, comply with local regulations, and establish a solid financial foundation for your business.

To submit the incorporation file to the Regional Investment Centre (CRI) in Morocco, you will need to follow these steps:

Before submitting the incorporation file, you need to make sure that you have all the necessary documents in order. This typically includes the articles of association, a certificate of deposit, a certificate of incorporation, and proof of payment of the required fees.

The CRI will provide you with the necessary forms for incorporating your company. These forms will include information such as the company's name, address, type of business, and the names of the directors and shareholders.

Once you have completed the forms and gathered all the necessary documents, you can submit them to the CRI. You may need to submit the documents in person, by mail, or online, depending on the specific requirements of the CRI.

The CRI will charge fees for processing the incorporation file. You will need to pay these fees in order for the CRI to process your application.

After you have submitted the forms and documents, and paid the fees, the CRI will review your application. If everything is in order, the CRI will approve your incorporation and issue a certificate of incorporation.

Note: The exact process and requirements for submitting an incorporation file to the Regional Investment Centre (CRI) in Morocco may vary, so it is important to check with the CRI for specific instructions and requirements.

In Morocco, the Central Register of Commerce (CRI – Centre Régional d’Investissement) is responsible for managing the registration of businesses and companies. If you wish to withdraw your company’s incorporation file or amend your registration details, you need to follow the necessary procedures.

Here’s a step-by-step guide to withdrawing your incorporation file from the CRI in Morocco:

To begin the process, visit the CRI office closest to your registered company's location. Alternatively, you may be able to access some services online through the CRI website or the "Portail National des Entreprises"

Before visiting the CRI, ensure you have all the necessary documents required for the process. This may include your company's original incorporation documents, registration certificate, and any other pertinent legal paperwork.

At the CRI, request and complete the appropriate forms for withdrawing your incorporation file. Be prepared to provide details about your company, such as its name, registration number, and the reason for withdrawing the file.

There may be administrative fees associated with the withdrawal process. Ensure you have the means to pay these fees, which may vary depending on your company's structure and the nature of your request.

Once you have completed the forms and paid the fees, submit your application to the CRI. They will review your request and verify the documents you have provided.

After submitting your application, wait for the CRI to process your request. The processing time may vary depending on the complexity of your case and the workload at the CRI. You will be notified once your request has been approved, and your company's incorporation file has been withdrawn.

After successfully withdrawing your company's incorporation file, ensure you notify all relevant stakeholders (e.g., banks, suppliers, customers) about your company's changed status.

Keep in mind that withdrawing your incorporation file can have legal, financial, and tax implications. Therefore, it is essential to consult a legal or financial advisor to understand the consequences of this action for your business.

legal advertising, also known as public notice or legal notice, is a requirement for companies in Morocco to inform the public and relevant stakeholders about specific company-related events or changes. These notices can be published in official gazettes or newspapers, ensuring that the information is accessible to the general public.

Some common reasons for legal advertising in Morocco include:

When incorporating a new company, it is necessary to publish a legal notice announcing the establishment of the company. This notice should include information such as the company's name, registration number, address, objectives, and share capital.

Any significant changes in a company's structure or operations, such as a change in the company's name, address, management, share capital, or legal form, must be announced through a legal advertisement.

If a company is going through a liquidation or dissolution process, it is required to publish a legal notice providing details of the decision, the liquidator's appointment, and the deadline for submitting claims by creditors.

n cases of bankruptcy or insolvency, a legal notice is needed to inform creditors and the public about the company's financial status and the appointment of a bankruptcy trustee.

When two or more companies decide to merge or when one company acquires another, a legal advertisement is required to inform the public and other stakeholders of the transaction and its details.

Companies are required to publish a legal notice announcing the date, time, and location of their AGMs, along with the agenda items to be discussed.

To publish a legal advertisement in Morocco, follow these steps:

Based on the purpose of your legal notice, gather the necessary information and ensure that it complies with the specific requirements of Moroccan company law.

Legal advertisements can be published in an official gazette or a widely circulated newspaper. Some examples of newspapers commonly used for legal advertising in Morocco are Les Eco, L'Opinion, or Le Matin. Check the regulations governing legal advertising in your company's specific industry, as some sectors might have additional requirements regarding the choice of publication.

Draft the legal notice, ensuring it contains all the required information and follows the appropriate format.

Contact the chosen newspaper or official gazette and provide them with the drafted advertisement. Pay any applicable fees for the publication.

After your legal notice has been published, keep a copy of the publication as proof that the legal advertisement requirements have been met.

Always consult with a legal professional when preparing legal advertisements to ensure compliance with Moroccan laws and regulations.

Once a company is established in Morocco, it must fulfill several legal, financial, and administrative obligations to remain compliant with the country’s laws and regulations. Here’s a summary of the key obligations a company must adhere to in Morocco:

The company must be registered with the Central Register of Commerce (CRI), and any changes to the company's structure, management, or activities must be promptly reported to the CRI.

The company is required to publish legal advertisements in an official gazette or newspaper for specific events, such as company formation, changes in structure, liquidation, and annual general meetings (AGMs).

Companies must maintain accurate financial records in compliance with Moroccan accounting standards. You must prepare annual financial statements, including a balance sheet, income statement, and cash flow statement. Balance sheet, income statement and cash flow statement.. These documents must be audited by a certified public accountant if the company exceeds certain size thresholds or operates in specific sectors.

Companies must comply with the Moroccan tax system, which includes corporate income tax, value-added tax (VAT), and other taxes, depending on the nature of the business. They must file periodic tax returns and make necessary payments to the tax authorities.

Employers must register with the National Social Security Fund (CNSS) and make regular contributions for their employees. This covers benefits such as retirement pensions, family allowances, and health insurance.

Companies must adhere to Moroccan labor laws, which regulate various aspects of the employer-employee relationship, including contracts, working hours, minimum wages, and occupational health and safety.

Companies are required to hold an AGM at least once a year to approve the financial statements, appoint directors, and discuss other important matters. Notice of the AGM must be provided to shareholders in advance.

Companies must maintain up-to-date records, including financial accounts, shareholder registers, and minutes of board meetings and AGMs.

Depending on the industry in which the company operates, it may need to comply with additional laws and regulations. This may involve obtaining specific licenses or permits and adhering to industry-specific reporting requirements.

To ensure compliance with these obligations, it is advisable for companies operating in Morocco to engage the services of legal, accounting, and tax professionals who can provide expert guidance on the relevant laws and regulations.

In Morocco, the Foreign Exchange Office (Office des Changes) is responsible for monitoring and regulating foreign exchange transactions and implementing the country’s exchange control regulations. Companies involved in international trade or transactions with foreign entities are required to report relevant activities to the Foreign Exchange Office.

Here’s an overview of the key reporting requirements for companies dealing with foreign exchange transactions in Morocco:

Moroccan companies engaging in import or export activities must declare the related transactions to the Foreign Exchange Office. This includes providing information on the nature and value of goods or services involved, the foreign currency amount, and the corresponding payment or receipt.

Companies receiving foreign investment or investing abroad are required to report such transactions to the Foreign Exchange Office. This includes foreign direct investment, portfolio investments, and foreign loans. The reporting requirements may vary depending on the nature and size of the investment.

Companies involved in cross-border financial transactions, such as loans, guarantees, and transfers, must report these activities to the Foreign Exchange Office. This ensures compliance with Morocco's foreign exchange control regulations, which are aimed at preventing money laundering, tax evasion, and other illicit activities.

Moroccan companies with foreign exchange transactions are required to submit annual foreign exchange reports to the Foreign Exchange Office. These reports provide an overview of the company's foreign exchange activities during the reporting period, including imports, exports, investments, loans, and other relevant transactions.

Companies must comply with the Foreign Exchange Office's regulations regarding the use and repatriation of foreign currency. This includes ensuring that foreign currency receipts are properly repatriated to Morocco and converted into Moroccan Dirhams within the prescribed timeframes.

Gather relevant information: Collect the necessary information related to the foreign exchange transaction, such as transaction details, amounts, currencies, and counterparties.

Complete the required forms: Obtain and complete the appropriate forms for reporting the transaction to the Foreign Exchange Office. Forms can be found on the Office’s official website (www.oc.gov.ma).

To ensure compliance with Morocco’s foreign exchange control regulations, it is advisable for companies to consult with financial professionals or legal experts who can provide guidance on reporting requirements and other obligations.

When starting a business in Morocco, consider the following recommendations:

Engage a professional to conduct a preliminary study: Seek the assistance of a professional to assess the legal, social security, and tax implications of your business venture in Morocco.

Transfer initial capital in foreign currencies: To enjoy the benefits of freely transferring profits generated by foreign investments, foreign investors must transfer the initial paid-up capital in foreign currencies.

Avoid standard articles of association templates: Refrain from using generic articles of association templates that may not align with your company’s unique characteristics and operational model.

Draft a partnership agreement for multiple shareholders: If your company has several shareholders, it is advisable to create a partnership agreement to govern their relationships and responsibilities.

Choose a reputable business center: Ensure that the chosen business center is located in a well-known business area, has a solid reputation, and is unlikely to close unexpectedly. Exercise caution when signing a domiciliation agreement.

Hire an English-speaking advisor: Engage an English-speaking chartered accountant or corporate lawyer to assist with the incorporation process and prevent potential issues.

Protect your intellectual property: To avoid disputes, it is crucial to safeguard your business by registering a local trademark for your intellectual property.

By following these recommendations, you can enhance the success and stability of your business venture in Morocco while minimizing potential risks and challenges.

The cost of starting a company in Morocco can vary depending on the type of company, legal and administrative fees, and professional services required during the incorporation process.

In Morocco, companies are subject to various taxes depending on their nature, size, and activities. Below is a summary of the main taxes applicable to companies in Morocco:

Corporate Income Tax is applied to a company’s taxable income. The tax rate depends on the nature of the company and its activities. The following table provides the CIT rates:

Type of Company Tax Rate in Morocco

Companies with a turnover below 5 million MAD10%Companies with a turnover between 5 million and 50 million MAD20%Companies with a turnover above 50 million MAD31%Banks, credit institutions, and insurance companies37%

VAT is a consumption tax levied on goods and services at each stage of the production and distribution process. The following table presents the VAT rates in Morocco:

Type of Goods/ServicesVAT Rate in Morocco

Basic food products, water, education, health, and transportation services0% (exempt)Agricultural equipment, certain pharmaceuticals, and press7%Most goods and services10%Alcoholic beverages, luxury goods, and specific services20%

Withholding Tax is applied to certain payments made by Moroccan companies to residents or non-residents, such as dividends, interest, royalties, and service fees. The rates may vary depending on the type of payment and the recipient’s tax residence status.

Companies are responsible for withholding and remitting payroll taxes and social security contributions on behalf of their employees. The following list summarizes these contributions:

National Social Security Fund (CNSS): 12.11% employer contribution and 4.48% employee contribution

Pension and Disability Insurance: 7.93% employer contribution and 3.97% employee contribution

Health Insurance: 2.26% employer contribution and 0.51% employee contribution

Professional Training Tax: 1.6% employer contribution

Note: The exact rates and contributions may change over time and depend on the specific industry or sector. Always consult a tax professional or legal expert to ensure you have up-to-date information about the Moroccan tax system.

Yes, foreigners can own a business in Morocco. The country has made significant efforts to create an investor-friendly environment to attract foreign investment. There are no specific restrictions on foreign ownership, and non-Moroccan citizens can establish and own companies in most industries.

Starting a Limited Liability Company (LLC) in Morocco involves several steps. Please note that while the information provided below can be helpful, it’s always recommended to consult with a local attorney or business consultant for up-to-date information and guidance tailored to your specific situation.

The most common types of legal entities in Morocco are SARL (Limited Liability Company), SA (Joint Stock Company), and SMEs (Small and Medium-sized Enterprises).

The minimum requirements for setting up a company in Morocco include having at least one shareholder, one director, a minimum capital requirement, and a registered office in Morocco.

The process for registering a company in Morocco involves several steps, including obtaining a business permit, registering the company with the trade register, obtaining a tax identification number, and registering for social security.

Companies in Morocco are subject to corporate income tax, value-added tax (VAT), and other taxes and duties depending on the type of business activity.

Some of the sectors with potential for investment in Morocco include renewable energy, tourism, agriculture, automotive, aerospace, and IT, green hydrogen, real estate,travel agency, import and export, car agency, hotel.

list of some American companies that operate in Morocco:

In Morocco, the legal form that is equivalent to a limited liability company (LLC) is called a Société à Responsabilité Limitée (SARL). A SARL is a type of company where the liability of the shareholders is limited to their capital contributions, and the company is managed by one or more managers who can be either shareholders or non-shareholders. The SARL is a common form of business in Morocco and is suitable for small and medium-sized enterprises.

With a budget of $17,000 USD, there are several business opportunities to explore in Morocco. Your decision should be guided by your skills, interests, and the local market demand. Here are some options to consider:

Small Café or Street Food Kiosk: Moroccan food is well-liked by both locals and tourists. With your budget, you can establish a modest café or street food stand, offering traditional Moroccan cuisine, fusion dishes, or international favorites.

Language Instruction Center: If you are proficient in multiple languages, consider opening a language school providing lessons in Arabic, French, or local dialects like Darija. Focus on individual or small group sessions to reduce overhead costs.

Artisanal Crafts and Souvenirs Store: Collaborate with local artisans to sell unique Moroccan handicrafts, mementos, and traditional clothing. Establish a compact retail space in a tourist-heavy location or utilize online platforms to reach a wider audience.

Budget Hostel or Guest House: Allocate your budget towards leasing or renovating a small property and transforming it into a hostel or guest house. Cater to cost-conscious travelers by offering clean and reasonably priced accommodations.

Digital Marketing or Social Media Management: If you possess expertise in digital marketing or social media, create a business that assists local companies in expanding their online presence. Such a business typically has low overhead costs and can be operated from home.

Niche Import/Export Business: With your available funds, initiate a small-scale import/export venture focusing on specialized products like artisanal items, textiles, or distinct food products. Be prepared to handle customs, shipping, and logistics.

Before embarking on any business endeavor in Morocco, conduct thorough market research, familiarize yourself with local regulations, and comply with any legal requirements. Networking with local business owners and entrepreneurs can also offer valuable insights and advice.

With $500 in a country like Morocco, you can start a small-scale profitable business. Here are a few business ideas that could work within your budget:

Food Stand: Start a small food stand selling traditional Moroccan food such as tagine, couscous, and street food items like sandwiches or kebabs. Focus on popular and affordable meals that cater to both locals and tourists.

Online Store: Set up an online store selling unique Moroccan crafts and artisan products like pottery, rugs, and textiles. Partner with local artisans to source products and promote your store through social media and targeted online advertising.

Tour Guide: If you have good knowledge of the local culture, history, and attractions, consider starting a tour guide business. Offer customized and small-group tours to tourists visiting Morocco, focusing on unique experiences like food tours, historic site visits, or cultural immersion.

Language Tutor: Offer language tutoring services to locals and tourists interested in learning English or another language you are proficient in. Conduct lessons online or in person at cafes or public spaces.

Mobile Phone Repair: Start a mobile phone repair service, as smartphones are ubiquitous and repair needs are common. Learn basic repair skills and offer affordable services in your local community.

Second-Hand Clothing Store: Collect gently used clothing from locals or purchase from thrift stores, and resell at a small second-hand clothing store or market stall. You can also offer clothing alterations or upcycling services to add value to the products.

Morocco is a vibrant country with a diverse economy, making it an excellent destination for starting a business. Here are some preferred places and ways to go about touring Morocco for this purpose:

Start in Casablanca: Casablanca is the commercial capital of Morocco and an excellent place to start your business tour. The city is home to many business districts and has a robust infrastructure that can support your business needs.

Visit Marrakech: Marrakech is one of the most popular tourist destinations in Morocco, but it also has a growing business community. The city has several co-working spaces and networking events that can help you connect with local entrepreneurs.

Explore Tangier: Tangier is located in the north of Morocco and is a bustling port city. The city has a strategic location and is home to several free trade zones that make it an ideal destination for international business.

Determining the best business to start in Morocco that will do well for the next 10 years is a complex question that requires careful consideration of many factors, including market trends, consumer needs, and government policies. However, here are some business ideas that have potential for growth and sustainability in the coming years:

Renewable Energy: Morocco has ambitious renewable energy targets and is investing heavily in this sector. Starting a business in renewable energy, such as solar or wind power, could have long-term potential as the country continues to transition away from fossil fuels.

Agriculture: Agriculture is a crucial sector in Morocco, and there are opportunities for businesses that focus on value-added products such as organic farming, food processing, and exportation of Moroccan agricultural products.

E-commerce: The pandemic has accelerated the growth of e-commerce in Morocco, and this trend is expected to continue in the coming years. Starting an e-commerce business that caters to local consumers or sells Moroccan products to the global market can be a lucrative opportunity.

Education: Morocco has a growing demand for high-quality education, especially in STEM fields. Starting a private school, offering tutoring services, or developing educational software can be a viable business opportunity.

Health and Wellness: With an increasing awareness of the importance of health and wellness, starting a business in this sector, such as a gym, wellness center, or nutrition coaching, can have long-term potential in Morocco.

It is important to note that starting any business requires careful planning, research, and execution, and success is not guaranteed. It is recommended to conduct a thorough feasibility study and seek advice from local experts before embarking on any business venture.

Yes, but you’ll need to comply with the country’s regulations and ensure that your products meet the necessary safety and quality standards.

Take the first step today and get your free consultation now! Unlock the potential for success for your new business in Morocco.

Request a free quote now !